The answer to the title is " Because we do not know what is normal anymore. We cannot rely on fundamental, statistical. or cash flow models to help handicap future events. Therefore we hedge risk based on our own cash preservation needs.

From the Article: "As long as the FED and CBs continue to support the stock and bond markets via ZIRP, it remains possible for these markets to maintain (and even increase) the high valuations, even as the banks make it harder for corporations and individuals to get their hands on the money they need"

Simply put, when fundamentals fail or are simply not applicable due to some 500 lb gorilla in the market, traders often turn to cash flows. Unfortunately that can be unreliable as well. Normality has been repealed and stochastic processes like overbought and oversold as a function of those cash flows shrink in meaning. Especially when a printing press can move the fence posts as to what a rational market will tolerate. All the more reason to hedge as a professional.

- Soren K

Originally submitted under the title: Sitting on a Hedge is More Comfortable Than it Sounds- edited by SK.

Written by ANG Traders: All summer we have been pointing out how disconnected from the real economy the market is. This position arises from a number of metrics (see SA articles here and here): the near-historic high PE ratio, the two-decade high price to sales ratio, low capacity utilization, decreasing sales, and decreasing profits. The market certainly looks unreasonable from an economic perspective, which is why we need to be both wary, and aware. Wary of the market’s irrational behaviour, and aware of the fact that we cannot impose reason on an unreasonable market.

The market morphs into a casino on a fairly regular basis; that much we know. What we do not know, is when the music will stop and end the game of economic musical-chairs that is taking place inside the casino. We don’t know, therefore we hedge.

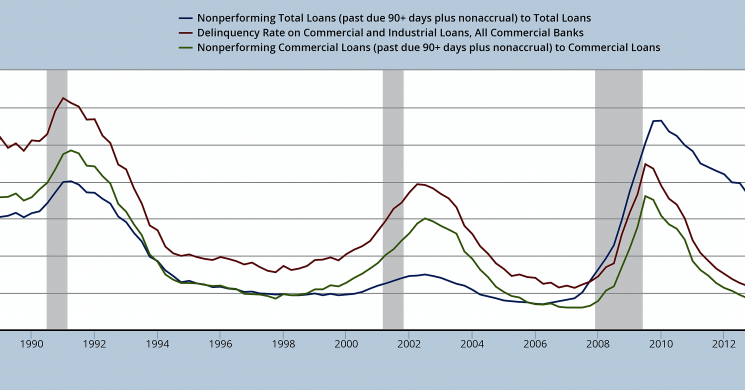

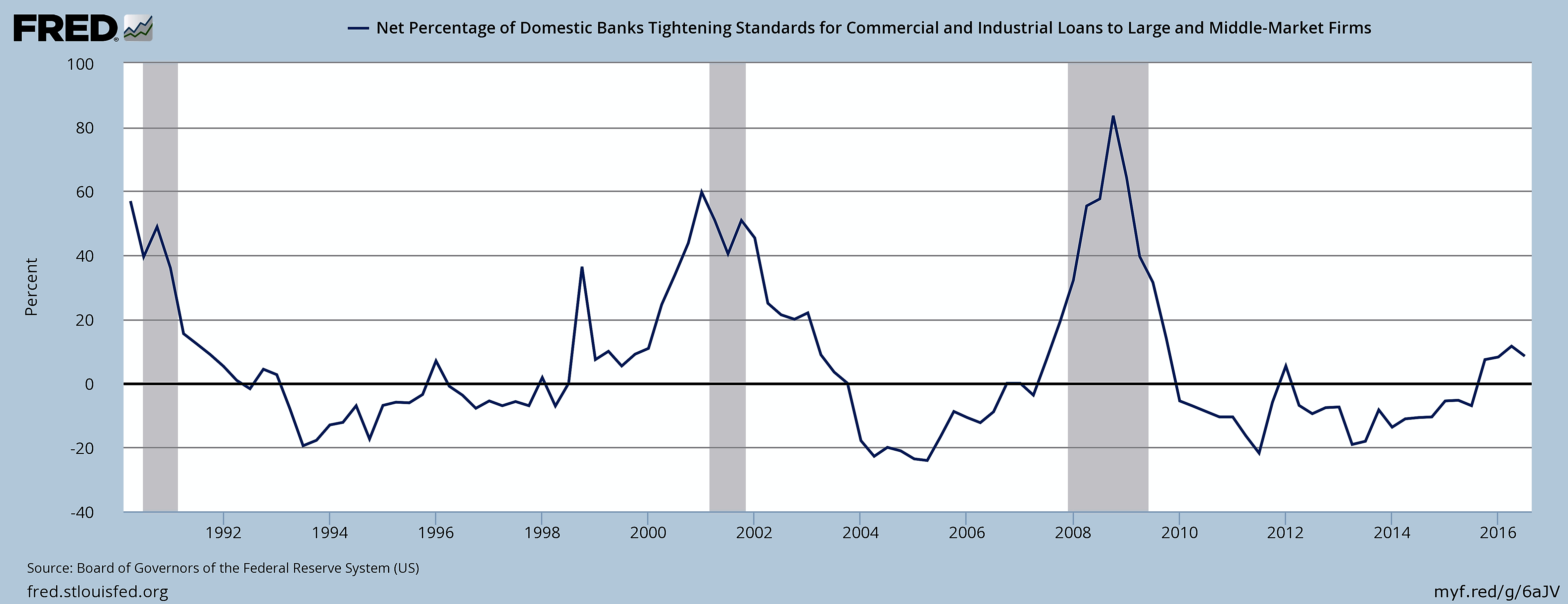

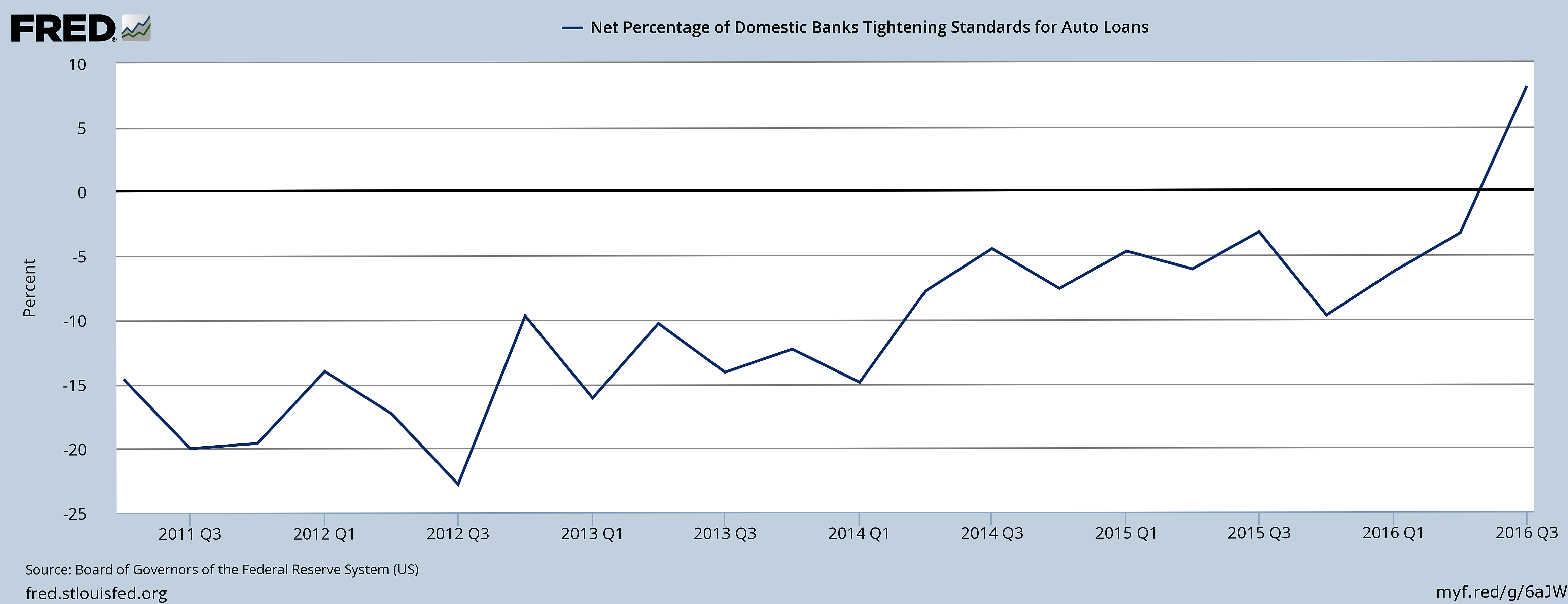

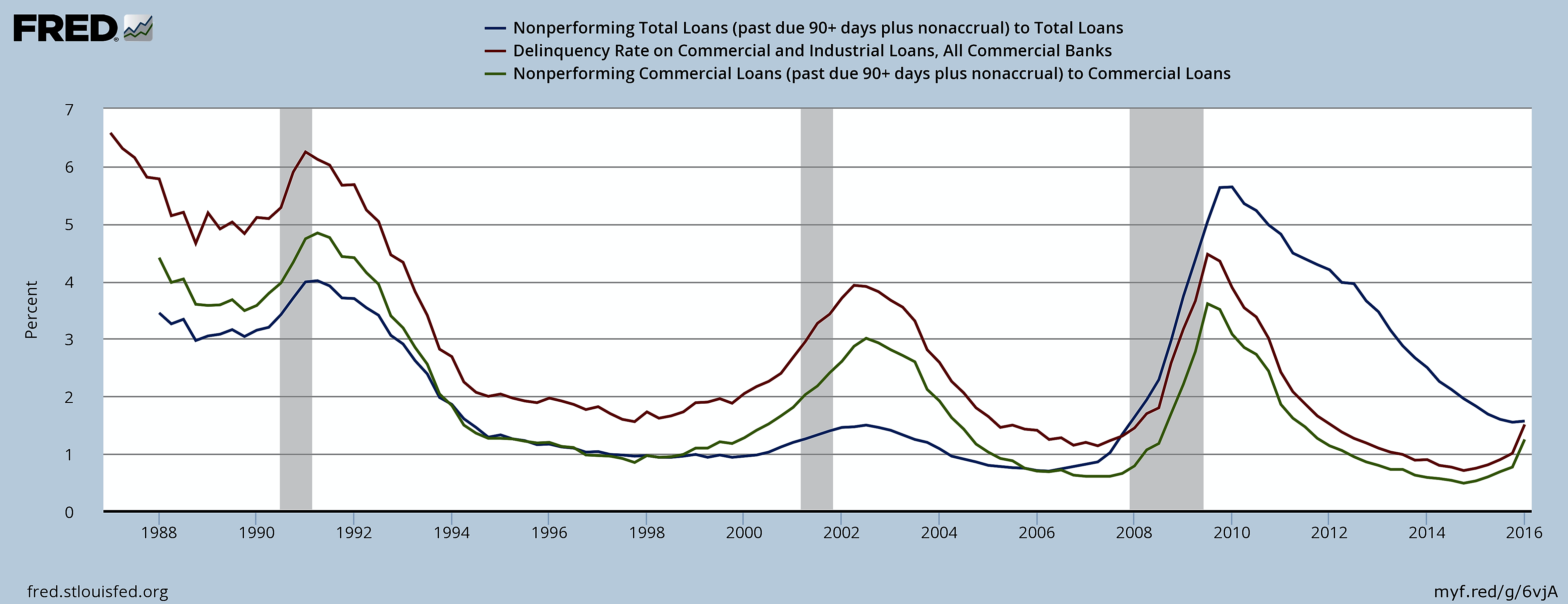

It has been said that “it is all about money flows; if all the money is over-there, then it can’t be over-here”. Childishly simple, but simply true. The money is in the banks, and they are the gate-keepers into the economy. Since 2008, the banks have not been putting enough money into the economy (loans for share buy-backs don’t count), and now they seem to be tightening-up on the money that they do lend. The next three graphs illustrate this:

Percent of Banks Tightening on Commercial and Industrial Loans

Notice how this tightening is a characteristic of late-stage business cycles. We are wary when banks start to lose confidence in their commercial clients, but we are aware that this tightening can precede a recession by years, as it did in the 1999-2001 lead-up to the tech crash.

Percent of Banks Tightening Standards for Car Loans

Tightening on car loans means banks are starting to lose confidence in consumers. This is not a good sign either.

Delinquency Rates on Loans

This increase in delinquencies is what normally occurs late in the business cycle ahead of a recession. The operative word, however, is ‘normal’, and since zero interest rates are not ‘normal’, it is very possible that the Central Bankers (CB) will continue playing the music that sustains the game; they can always start buying equities and ETFs themselves. Market participants (money managers) HAVE to put their money somewhere, so what better place is there than the stock market, or bond market where the FED and other CBs have eliminated the risk? If you have the CBs as guaranteed buyers, then where’s the risk? As long as the music plays, it doesn’t matter that all the chairs are gone.

As long as the FED and CBs continue to support the stock and bond markets via ZIRP, it remains possible for these markets to maintain (and even increase) the high valuations, even as the banks make it harder for corporations and individuals to get their hands on the money they need (see SA article by Heisenberg).

It is obvious that starving corporations (of cash) cannot be sustained for ever. But, it is also obvious that it is impossible to predict when it will end, therefore, we hedge all positions…whether long or short.

Related, but not the focal point of the article above: Sitting on a hedge brought real discomfort to those who held hedges during the Brexit moves as their theta exposure skyrocketed. In fact, the smaller investor playing unleveraged was better off not hedging, thus not worrying about market events. But, the authors are describing a long term philosophy which we agree with. Proper hedging and cash management serve all well in this seemingly unending distortion of market norms. You don't want to be unhedged when the rubber band finally snaps. That includes inflationary hedges.Soren K.

Read more by Soren K.Group