Market Recap

Stocks were up globally with the Nikkei leading the way Monday in Japan after weekend elections gave PM Abe's party a super majority. This gave a mandate to continue current policies of easy money and QE. The yen was weaker against every major currency through the US hours. Precious Metals started the evening off very strong on the back of Chinese and Japanese buying from the threat of more currency devaluation. Dr. Copper was the leader up 3% on Sunday night in the US. By the end of US trading Gold had weakened considerably, but Silver kept half its Asian gains (See chart below). Oil started the evening weaker and remained soft throughout the day.- Soren K.

Chart of the Day- temper that Nikkei euphoria please

Nikkei vs. S&P 500 this year.- easy money works for us, why not you?

- chart Bloomberg

Seasonality in Gold/ Silver Ratio?

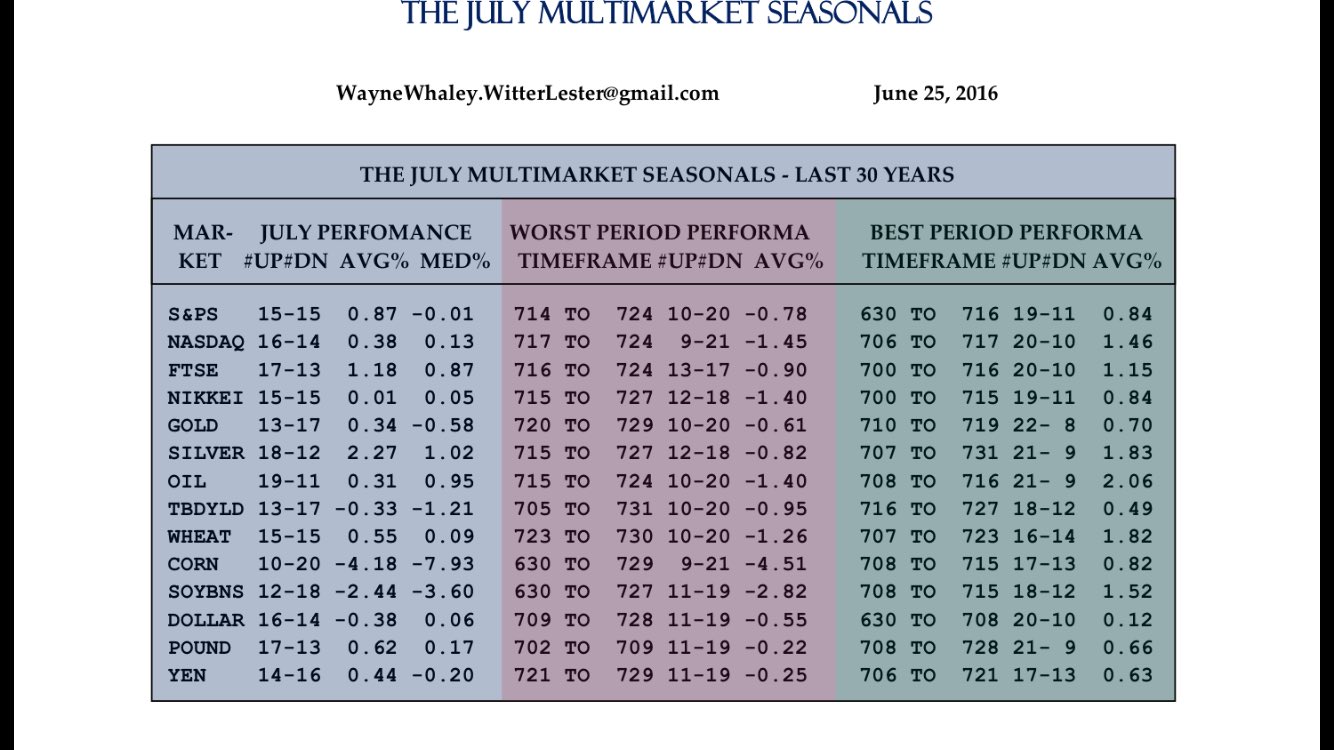

We came across this grid from Wayne Whaley and noted July is a month where Precious Metals diverge frequently. Today Silver finished up about $.20 while Gold finished down $4.00. Seasonality may be something to keep in mind when looking at the Gold/Silver ratio

Gold and Silver Diverge in July

Markets

Today: Silver Continues to Attract Buying- as Asia buys, The US front runs on the close

-for interactive chart click here

Equities

- S&P: 2141 + 11.50 New all time high today

- Dow: 18259 +112

- Nikkei: 16110.00 +2.5% closed

- FTSE: 6625 +1.16% closed

Currencies v. USD

- Yen: 102.8 0 +2.25% ( weaker)

- GBP: 1.299

- EU: 1.10

- Gold in Yen 4451 UP

- Gold in EU 1225 DN

- Gold in GBP 1043 DN

Commodities

- WTI: 44.93 -0.48

- Nat Gas: 2.71 -0.09

- Gold: 1354 -4.20

- Silver: 20.32 + .22

- Copper: 214.55 + 2.6

Bernanke met Kuroda Monday- to talk grandchilden

- pic courtesy Bloomberg

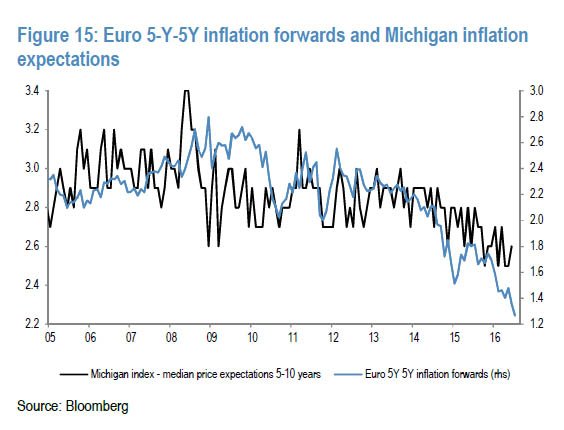

Deflation Still Bankers' Concern

Negative yields are forcing the next step for Central Bankers. As bonds become ineligible for QE support, other assets will be considered.

Ben Bernanke visited Kuroda today. It should be clear why given today's market activity. Concerns about debased currencies are not high priority. Deflation is still the biggest concern as you can see from the chart below.

h/t Zerohedge

Our real problem is how can a banker have confidence in their skills to keep inflation in control and stay on "target" once it finally does get going when they haven't been able to stem deflation for a decade?

Further reading

GoodNight

-Soren K

Read more by Soren K.Group