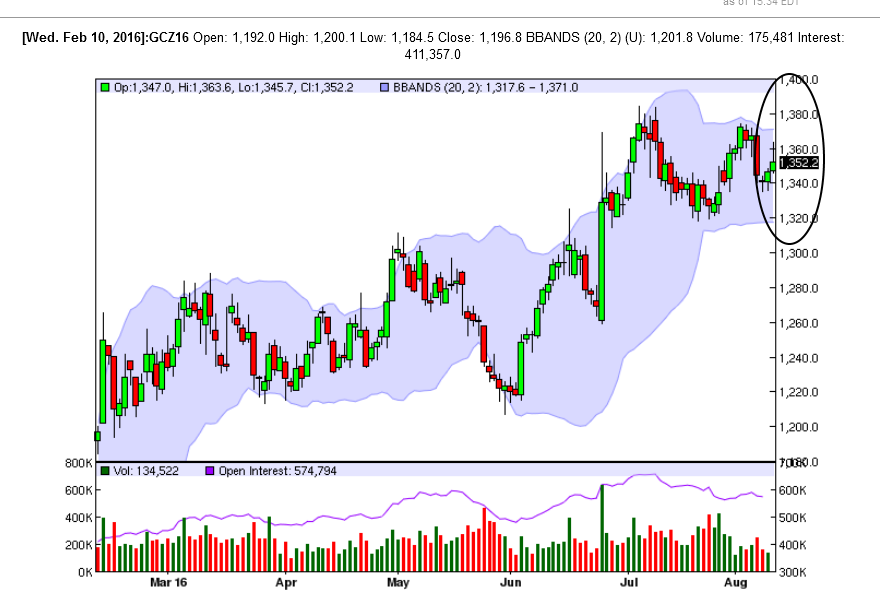

Earlier today we alerted readers for a possible Gold momentum breakout on the Bollinger Band system. We also gave you the counter trade if you were bearish. Larger point here is that once you have a potential signal for a move on any system, a failure to trigger it by definition is a reason to go the other way. Today reminded us just of that. We don't like to admit it, but the short side trade idea combined with the failure of the BBand set up gives us pause. The trade to do today was exactly as described below

What if the BBand break out doesn't materialize? Here is the trade from the short side that is precisely how one would play the market if the market was not on the highs near the close.

DEC GOLD: Rallies above the trend line that fail to settle above 1360 alert for a bigger correction. Consider selling at 135310-50 and risk 135880 Stop.The objective is 133970 or exit by the close- from the earlier post How to trade Gold today

Bull break out- No Dice today

And that was the better trade today. Short below 135310. As a day trade it offered almost no profit, but as a 2 day trade after the rejection of our BBand trigger, we are a nervous bull.

GOLD DAILY CHART FOR TODAY

- Gold did not close above 1360 thus

- the Bollinger Bands did not widen

- Gold broke down cleanly from 1358 and trended lower the rest of the day

- It did not touch 135880 after dipping below 135310

- it also did not break down to 133970 as projected.

All in all no trades were done. Which is good and shows that we are just in a bigger range now. But the downside is now vulnerable again.

- Bernanke Thinks Fed Will Hesitate On Its Next Rate Hike

- Trump’s Economic Speech Was Enough to Convince Carl Icahn

- Did PIMCO just front run the Fed?

- The Silver Lining In A stock Market Crash

- Pension Partners: ignore the deflation hype

Soren K

Read more by Soren K.Group