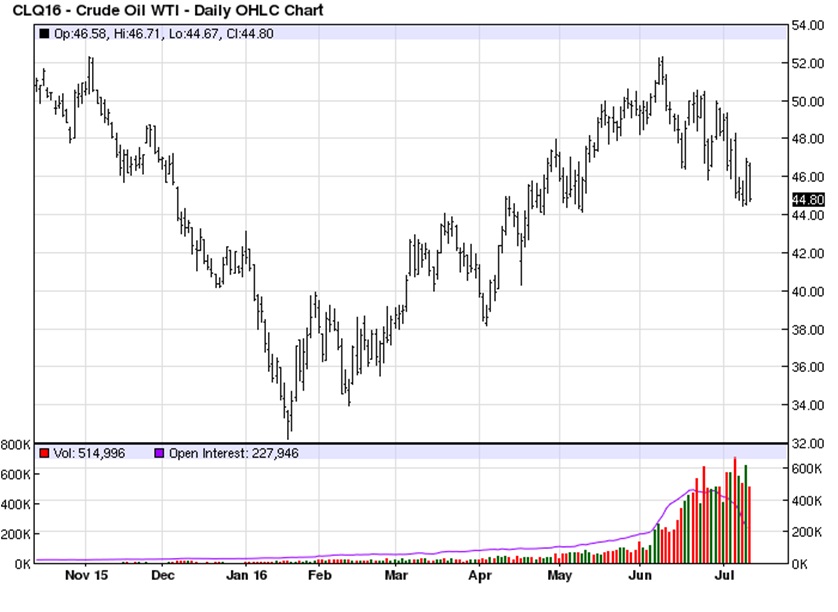

Although oil has had a pretty good run this year the rally is looking long in the tooth and investors should pay close attention to the $44 level as a break below this support level to signal more weakness as the world comes to grips with lower economic growth and lower demand forecasts.WTI crude oil is trading at its lowest levels since early May with prices hovering below $45 a barrel. Since hitting its multi-year lows in late January, prices are up 33%. Although still well up on the year, price have dropped dramatically since its early June highs of $52 a barrel.Back in early-June, I warned that oil was looking a little over-bought and was expecting to see a pullback. Since then prices have broken below my initial support levels at $48 and $47.50 and we are now eyeing the key level at $44.

Not only is the world still well supplied with oil, I remain bearish in the near-term because of weak demand, highlighted in today’s crude oil inventories data.Oil prices slid sharply Wednesday following inventory data which showed a disappointing draw in crude oil supply. Inventories last week fell by 2.5 million barrels versus expectations for a decline of 2.3 million barrels. Crude oil inventories dropped but gasoline and distillate supplies increased, which shows that demand for refined products is not very strong.The reality is that the summer driving season is almost over and once we get past September we can expect to see another build in crude oil.While I am expecting to see a further drop in crude oil, I think we have seen the lows for this cycle. I think we could prices drop to $36 a barrel by the end of the year before we see renewed support come back to the marketplace.