Recap

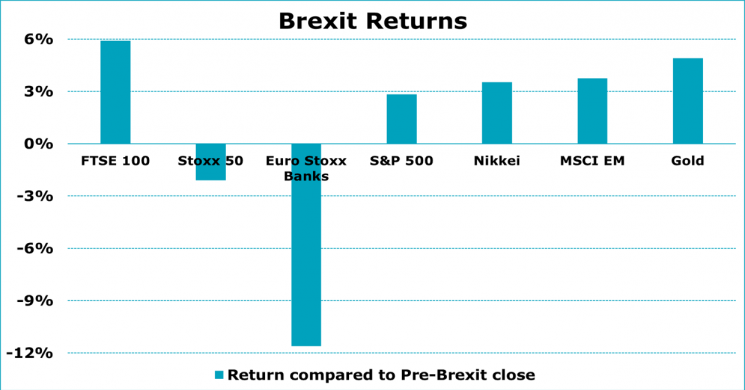

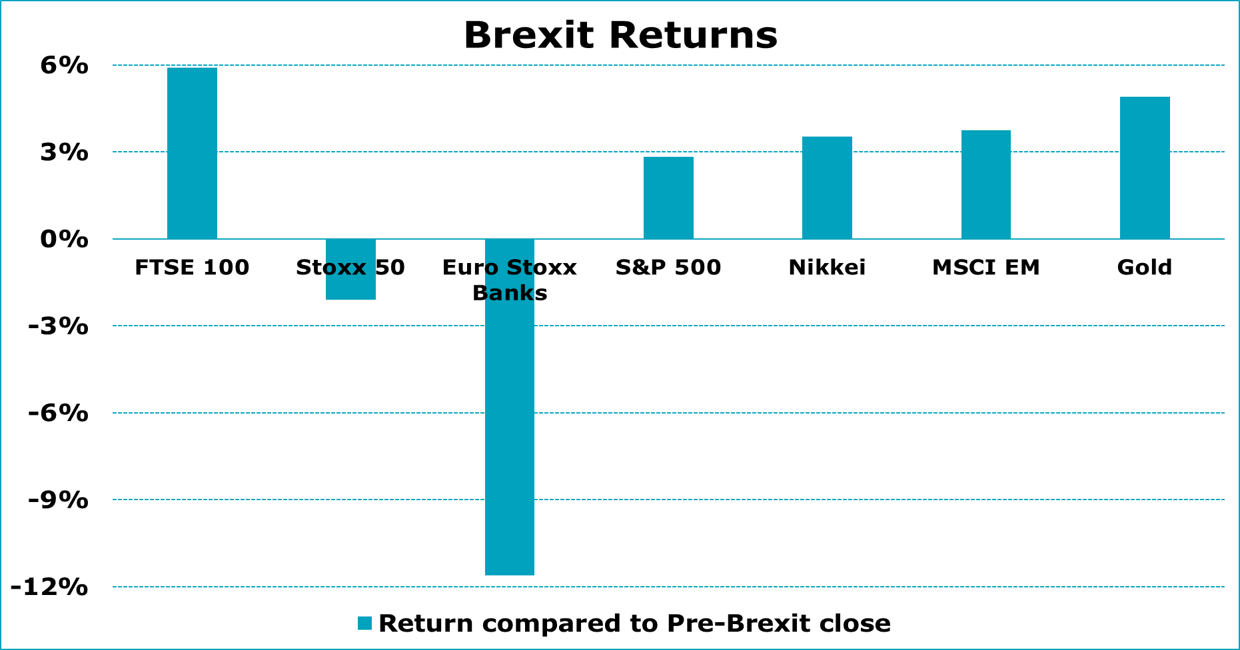

Yen stronger on Kuroda statements, Stocks softer on Turkish emergency statement and shrinking prospects of more stimulus. Gold recoups some losses. Quantitative Easing's effectiveness is doubtful at best. We cannot emphasize this enough. Gold has strengthened against every major currency post Brexit. If you must see it as a competing investment with stocks, then look at the chart below. Gold has outperformed global equities as well. Including the S&P outright. The FTSE? please.- Soren K.

S&P at All time highs? Gold Laughs

Headlines

- KURODA REJECTS Bernanke's HELICOPTER MONEY, YEN DROPS 1.5%- BBERG- because QE has done net NOTHING for 10 years

- TURKEY'S EMERGENCY RULE DOESN'T SIT WELL WITH EUROPE- RTRS- Erdogan is using his energy doorman status to leverage an enabling Europe

- TRUMP PICKS A FIGHT WITH CRUZ AT CONVENTION- BBERG- Video:Trump at War With Cruz

- BREXIT RECESSION IMMINENT, EU STOCKS LOWER- still unresolved as the 18% of the EU GDP is walking out the door

- HSBC'S JOHNSON ARRESTED THEN OUT ON BAIL POST FX ARREST- But Mike Coscia gets 3 years on gold trades

“The (Japanese) market had actually changed its sentiment and pricing based on the assumption that we would get something big on the fiscal stimulus side, and that Japan would be the first wave.”-Peter Garnry, Saxo Bank

BUY GOLD NOW- Stocks are pricing unicorns farting ice cream tacos

- As long as futures stay above 1301- they are

- Open Interest continues to decrease- it will decrease significantly more in 4 days

- Nothing is resolved Globally- it is actually worse

- You are just buying money- Gold is the strongest currency post Brexit

The Song Remains the Same h/t John G.

Chart Porn: Sell Stocks Now- Echobay Analyst

Markets

Commodities- slow night. Gold has bounced a little on demand, despite net USD strength

- Gold: 1322 +3.00

- Silver: 19.54 -0.07

- Copper223.55 +0.15

- WTI 4576 unch

- Nat Gas: 2.63 -0.03

- Grains: Corn, Wheat, Soy up

Currencies- Yen is stronger on rejection of helicopter money. GBP and Euro mixed. Gold is up against all except JPY, where it is moderately lower despite yen

- JPY:105.60

- EURO:1.10

- GBP: 1.32

- Gold/ jpy: 4465 - 40

- Gold/ euro: 1199 +4.70

- Gold/ gbp: 1001 +4.75

Stocks- lower across the board on Japans rejection of easier money, Turkish unrest, unresolved Brexit problems, and the creeping understanding that easy money don't work after the headlines subside

- Dow: 18500 dn 33

- S&P: 2163- dn 4.00

- Nikkei 225- up.5%

- FTSE, CAC, DAX all down .2 to .5%

Wrap Up

QE has not supported the Nikkei over the last 10 years. Despite post Brexit Cheerleading, Gold is the strongest there is, and Geopolitical events are adding to uncertainty. the VIX may be saying less volatility, but the chance of macro events as measured by another volatility instrument, Leptokurtosis, is growing. what is Leptokurtosis? It is a quantifiable way of understanding Murphy's law, or Black swan event chances. And more are coming.

More Reading

Read more by Soren K.Group