Some observations on, Gold, Easy money, QE, and Helicopter money.

News outlets are saying that Gold does not believe the FOMC optimism from yesterday. That is putting it gently. We say, Gold doesn't believe the lies that any chance of a hike is truly going to be honored in the future. The Fed has hiked something like 2x in the last 10 years. Empress Yellen has no clothes (apologies for the imagery) and the Fed cannot raise rates in any meaningful way. It will invoke helicopter money once it gets Japan to do so. In the meantime, it will continue to hold out the bogeyman rate hike voodoo doll to keep things in check. The next 25 basis points may be up, but the path of all FIAT currencies with the USD last, will be down. First, a post FOMC Gold update is in order. -Soren K.

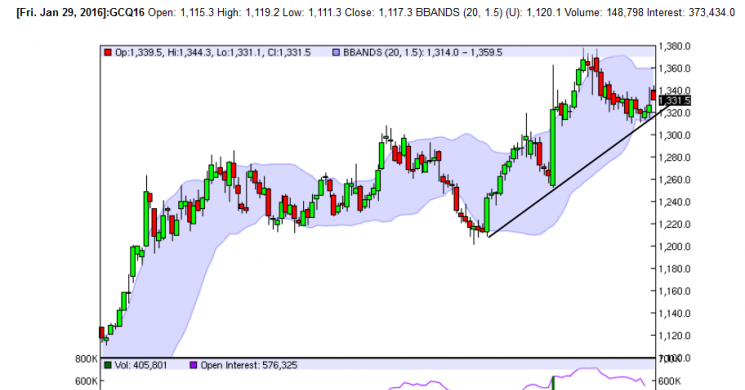

Gold and the Bollinger Band Setup

We'd like to see the market stabilize here for a few days. Sideways is now bullish at these levels

- the new range is 1320 to 1360

- A break of 1320 will widen the bands and accelerate a selloff- up from 1311 yesterday

- A trade above 1350 will likely do the same, but we cannot be sure

- A trade above 1360 will definitely do the same and $1400 will be easy-peasy to get to.

To get caught up read HERE for earlier analysis and explanation

- interactive chart here

Easy money> Quantitative Easing> Helicopter money> Profit????

-written by Vince Lanci of Echobay Partners, LLC

The Fed: Profiles in Cowardice

Why are we in the situation we are? The answer is a lack of courage. We have avoided taking our medicine for so long, that the necessary dose to cure the disease would now kill us. Hence we rationalize using"pot odds" and denial and self interest as rationalizations of staying on the current path to its logical end. The end is a collapse of an overly complex structure. A structure that uses xanax and coffee to balance its heroin and cocaine addictions. It's all going to crash when the fed loses confidence in its own self delusion.

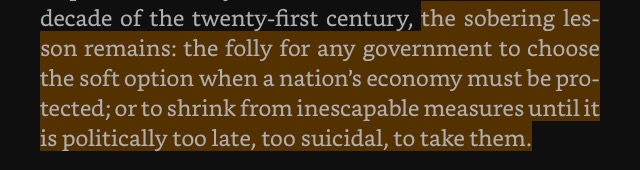

From When Money Dies- Adam Fergusson

Why Quantitative Easing Fails

QE puts the easy money in the hands of banks in the hopes that those banks will use that money for loans and investments for economic growth. Wall street is supposed to spend that money on main street. But when banks have horrible balance sheets from bad investments prior, they hoard that money to keep themselves solvent as more investments on their books go bad. Bad investments like mortgages in default. Our research and experience confirms this. That is not conjecture.

The bank carries those defaults on their books as performing loans through devious but legally accepted methods approved by the Fed. The money given them by the Fed is not used to finance main street as a result. It does not bring about the desired effect of getting people to spend more and save less and thus grow the GDP of a nation. The banks slow the use of money, keeping it out of circulation. Thus the Austrians and the Keynesians are right simultaneously.

- Austrian: Money is printed, thus there is inflation

- Keynesian: CPI is low, there is no inflation as the velocity of money is low.

- Echobay- We have inflation, it just hasn't metastasized to fiat yet.

Enter Helicopter Money

Helicopter money is the last, most direct attempt by government to influence markets out of a deflationary situation. There are different methods, but the goal is the same. To get the money into the hands of the consumer without the use of banks as intermediary. Hence images of dollars showering down on the people from a chopper. There are other more detailed aspects to it including THE PERMANENT MONETIZATION OF DEBT- as Bernanke suggested to Japan recently. But for now we will stick to the Government printing money and giving it directly to the public.

The Death of Fiat

At first glance, it seems less scary than QE. Actually accepted. Who wouldn't like an extra $2k in their tax refund? Sadly it is the beginning of the end. This is where prices start to speedily go up. What will people do with their extra money? A lot will buy iphones, driving the price of them higher. Anything that is in demand will INFLATE in price. Get it? We already have inflation anyway. It is currently in the form of stock prices that are too high. Keynesians don't call that inflation though. They call it asset bubbles. A kind of good inflation in their minds.

Bubbles are your friend little girl- come back!

But what happens when the extra QE money no longer gets shoved into stocks and bonds? Banks keep it in their mattresses until the Government forces it to be used. Then we get the BAD inflation as banks give money back to the government and the government drops it directly on the public. Things get more expensive, wages must go up s opeople can still buy things adn companies can remain profitable. Then the possibility of hyperinflation ensues.Here is the thing though. HELICOPTER MONEY IS NOT LEGAL

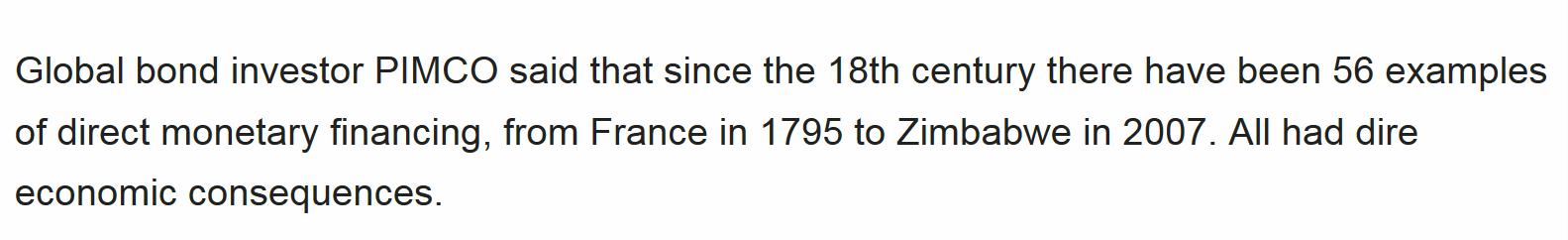

- Fact: QE has never worked. Direct monetary financing in any form has never worked

- What Central Bankers hear: This time it will be different

Bond Giant PIMCO on the history of QE and Helo Money

-Ironically, Helicopter Ben Bernanke is now a senior Pimco adviser.

- Fact: Rules apply only to those not in charge

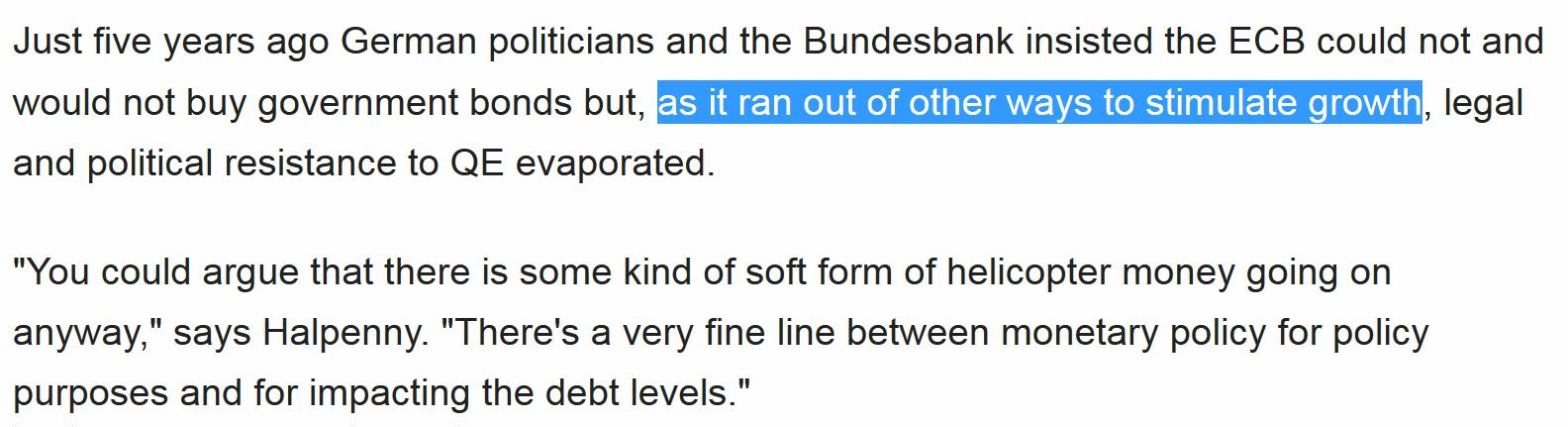

- Helicopter money should be a non-starter because most central banks are either explicitly or implicitly banned from direct monetary financing- RTRS

PIMCO AGAIN

-When the rules do not fit the Leaders' agenda, they change the rules

Helicopter Money is the Point of No Return

Dropping cash directly onto consumers may well be the end of that line and, if that fails to work, governments may be very reluctant to reinstate monetary financing bans in future - creating the threat of systemic collapse."The main difference between helicopter and other possibilities, lies in the credibility of the whole monetary system," Swiss economist Reto Foellmi told a discussion on Reuters Global Markets Forum this week. "If helicopter money is done literally, they would cross a point of no return." RTRS

You Cant Eat Dollar Bills Either Bud

If Helicopter money is implemented Gold will scream higher as global faith in FIAT (Fix It Again Treasury) currency deteriorates. That money will not be spent on stocks. It will be spent on things. Those things' higher prices will reflect the debasement of our own currency and result in inflation. Inflation always starts as a domestic problem. We will likely see Gold outperform in terms of Yen and EURO before finally taking off in USD. And if the Fed cannot justify Helicopter money now, We feel it will bide its time and seize on the next crisis, possibly manufactured to implement the decision to break the law and start the choppers. We feel this is best said here in a zerohedge article that quotes DB, who is in the best position to speak on the needs of helicopter money to save themselves.

From Zerohedge:

“So Japan will be the flag bearer of fiscal stimulus.” Which will be sufficient to breath some inflationary spirit into the system. “But this is all febrile and can get over-turned by the slightest change in wind direction,” he said, tentative.“This will be the little inflation before the big helicopter-driven inflation.” But that will first require a crisis. Full article here

In closing. a quote from Adam Fergusson's When Money Dies emphasis ours

"Over most of Germany the lead was beginning to disappear overnight from roofs. Petrol was siphoned from the tanks of motorcars, barter was already a usual form of exchange; but now commodities such as brass and fuel were becoming the currency of ordinary purchase and payment. A cinema seat cost a lump of coal. With a bottle of paraffin one might buy a shirt; with that shirt, the potatoes needed by one’s family. Herr von der Osten kept a girlfriend in the provincial capital, for whose room in 1922 he had paid half a pound of butter a month: by the summer of 1923 it was costing him a whole pound."

Suggested Reading

- Grain Report with Technicals

- FOMC meeting: Gold's gonna go

- Goldman Sachs Likes Gold But Doesn't Love It

- Soren K.

Read more by Soren K.Group