J Taylors Inflation/Deflation Watch

Ben Bernanke met with the Bank of Japan the previous week to advise them on how to implement “helicopter money.”

Ben Bernanke met with the Bank of Japan the previous week to advise them on how to implement “helicopter money.”

Don’t forget that Japan has been in a decades-long depression and nothing of a conventional nature, has worked. So what do you do when nothing in the past has worked? Would you question the wisdom of your policies to begin with? Not a chance because you, as a god of the Federal Reserve Bank, have no one smarter than you to turn to. So you double down as Ben Bernanke promised Milton Friedman. Referring to the 1930s, Bernanke promised Milton Friedman that this time the Fed won’t let him down. This time, by golly, we will provide enough stimuli fast enough that it will most certainly work.

Well here we are decades later in Japan and arguably 16 years since our first major bust in 2000, and nothing of conventional policy is working. So now Bernanke is going even further back to policies of failure in the past tried countless times namely to turn on the money creating machines at an exponential rate of speed and then most certainly everything will work out right? Well, pre hyper inflation Germany and pre French Revolution  France didn’t use helicopters. But that is about the only difference between past idiocy and the one now being implemented by central bankers in 2016. And it will come to a disastrous end.

France didn’t use helicopters. But that is about the only difference between past idiocy and the one now being implemented by central bankers in 2016. And it will come to a disastrous end.

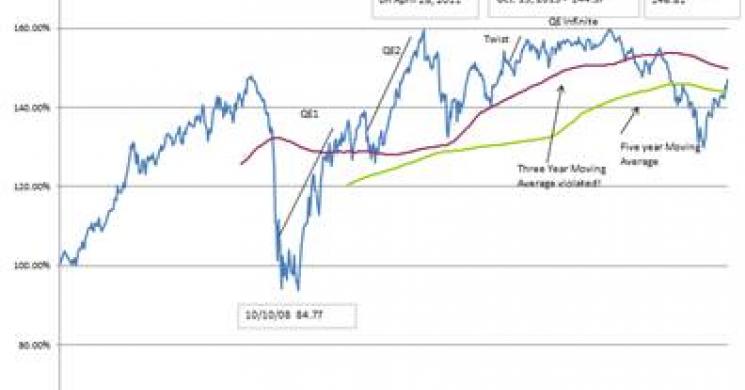

As Greenspan noted on Bloomberg TV on July 1, in the past whenever nations have put themselves into a situation like this, it always ends in inflation. Indeed my IDW is showing an inflationary breakout with the index now cutting through the 5-year moving average and getting close to the 3-year average. And as the chart on your left shows, even core inflation (which grossly understates the cost of living for Americans) is on the rise making it more difficult for the Fed not to raise rates given its pledge of dependency on data.

Now, economic data are pointing toward an economic recession even in America where propaganda artists are trying to assure us everything is at least alright if not great.

Now, economic data are pointing toward an economic recession even in America where propaganda artists are trying to assure us everything is at least alright if not great.

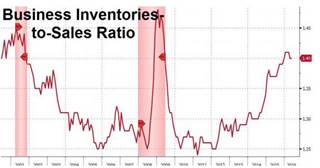

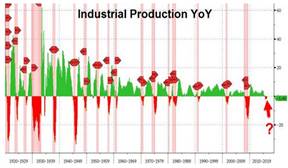

Business inventories have are the highest since the 2008-09 crisis. Autos and building materials are at their highest levels of inventories relative to sales since the financial crisis leaving overall business inventories-to-sales ratio hovering near cycle highs at 1.40x. A 0.2% rise in inventories (bigger than expected) matched the 0.2% rise in sales MoM but YoY it's a different picture with sales down 0.3% and inventories up 0.9% (with retailers seeing inventories surging 6.1%). And industrial production dropped 07% year over year in June which marked the 10th month in a row of declines. That is the longest streak without a recession in US history.

In the meantime, thanks to direct intervention to prop up stocks or indirect action through manipulation of the price of money by central banks around the world, stocks con tinue to rise even as GDP continues to decline around the world. But quite correctly the big rally in both stocks and bonds has some of the largest fund managers in the world very worried that we are in a bubble that will sooner or later pop, resulting in economic devastation. First it was bond gurus Bill Gross and Jeff Gundlach; then a few days ago equity titan, Blackrock’s Larry Fink joined in, followed by Oaktree's Howard Marks. As Bloomberg puts it, the big rally in stocks and bonds has some of the world’s top money managers "ringing the alarm" just as the S&P hits all time highs day after day after day.

tinue to rise even as GDP continues to decline around the world. But quite correctly the big rally in both stocks and bonds has some of the largest fund managers in the world very worried that we are in a bubble that will sooner or later pop, resulting in economic devastation. First it was bond gurus Bill Gross and Jeff Gundlach; then a few days ago equity titan, Blackrock’s Larry Fink joined in, followed by Oaktree's Howard Marks. As Bloomberg puts it, the big rally in stocks and bonds has some of the world’s top money managers "ringing the alarm" just as the S&P hits all time highs day after day after day.

Last week was a “risk on week” as Brexit jitters were put aside. Gold and U.S. Treasuries both declined but remain very much in bull markets according to Michael Oliver’s work. Believe me there is no reason to think we are in the all clear for anything given the rot underlying the world’s markets thanks to hubris intoxicated central bankers serving the Rothschild and Rockefeller gods. My view of the future, for whatever that is worth (I put my trust in our omniscient Creator ) has not changed. The way I see it is as follows:

) has not changed. The way I see it is as follows:

1) The global economy is heading down into a deep depression;

2) Central bankers will continue to look after their criminal “shareholders” by printing money and bailing them out such that the global economy continues to sink deeper into the quagmire;

3) The populace will continue to revolt ever more violently as policy makers and governments can no longer meet the basic human needs like food and shelter for the unemployed masses. With more violent revolutions, helicopter money, which has just now commenced in Japan, will lead to a surging inflation rate. As noted above we are only now starting to see “green shoots of inflation;”

4) With interest rates suppressed even as inflation starts to become a serious problem, buyers even of U.S. Treasuries will cease to exist. That will be the point at which Michael Oliver’s T-Bond Blow off ends and interest rates will start to rise and the Fed will be powerless to stop increased rates;

5) At that point, we will enter a horrific inflationary depression that will make the 1930s seem like a walk in the park on a sunny Sunday afternoon. Yes, gold will rise to at least keep up with inflation. But the carnage from social disorder and chaos will give no reason for joy even with a moon shot gold price.

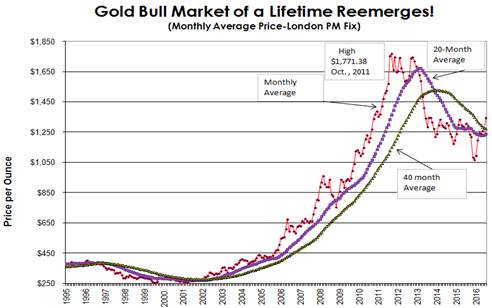

While this past “risk on” week caused gold to decline a bit, my monthly average gold price chart appears to be in agreement with Michael Oliver’s longer term vision for gold, namely that we are into a new substantial gold bull market. Michael thinks we will not see any serious resistance to this move higher in gold until we get into a range something like $1,450 to $1,540. The average gold price based on the London P.M. as of this past Friday was $1,346.50. That compares to a 40-month average of $1,271.92, and a 20-month average of $1,241.91.

While this past “risk on” week caused gold to decline a bit, my monthly average gold price chart appears to be in agreement with Michael Oliver’s longer term vision for gold, namely that we are into a new substantial gold bull market. Michael thinks we will not see any serious resistance to this move higher in gold until we get into a range something like $1,450 to $1,540. The average gold price based on the London P.M. as of this past Friday was $1,346.50. That compares to a 40-month average of $1,271.92, and a 20-month average of $1,241.91.

As I noted in my monthly letter, this is a bittersweet breakout for gold because it indicates all is not well in the world, which of course is why I am a gold bug to begin with. If only we had gold as money, I would not be a gold bug. I would focus my investment skills on productive businesses. But since policy makers are destroying our income, wealth, and economy by debasing our currency with fraudulent, counterfeit money that we are forced to use, trading fiat money for gold is the only means of survival. I am a gold bug simply because I realize at least within the four dimensions of time and space, owning gold is a precondition for financial survival when the system inevitably falls apart. Sadly, I think we are approaching that day all too soon.

Jay Taylorwww.Jaytaylormedia.comwww.miningstocks.com

Read more by jaytaylor