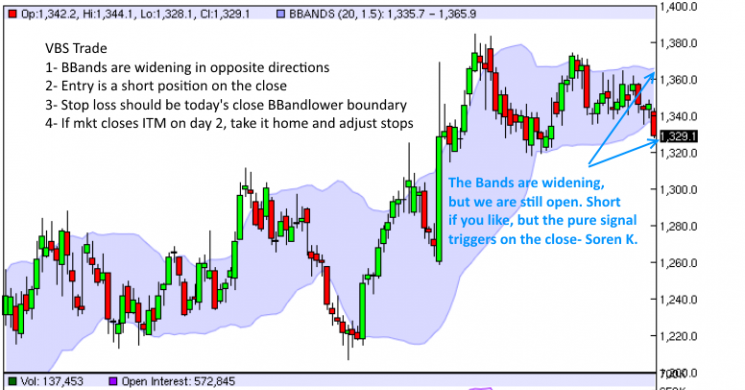

UPDATE: 2:46 Aug 24th: VBS Trade Entry

- Short Gold at $1328.20 near/on close Wednesday

- Overnight and tomorrow intraday stop loss is $1335.50

- Target is 2x the amount risked = $14.60= $1313.60

- If market comes in lower, option to lower stop loss to $1328.20

- Take half profits at target, lower stop for remaining position to Thursday's high of day. ( or take it all off, we get a little piggish depending on the time of day)

- Take whole thing off Pre Yellen either way. ( if ITM we might leave a tail of 1/3 position with no downside target and stop loss in place.) otherwise it's a discretionary exit

- A reversal during Yellen speech would likely be wicked e.g. "We are going to raise rates, we swear, just not this year"= lift off**

- Is Gartman Bullish? Go back to #1 above

** Deep pockets buy from panic sellers. If Gold drops $20 more do you think the Chinese will puke their position? Shake all the hot money out and let the longs be strong unleveraged hands.This is a swing trade for 2 days. We can easily see how a Fed induced swoon lower is a great opportunity for investors. Who has faith that these people can stop inflation when it starts while they still haven't put a stake in deflation after 8 years?

- How To Front Run Your Clients by Goldman Sachs

- The World’s Monetary System Is Broken & Costing Overseas Business

Background

Monday we alerted readers on a Silver short trade. We entered a position on this signal. Per the signal, we closed the position down with a tiny loss. You can read the painful autopsy if you like. And of course post our covering, Silver is now lower. But that is not the point of this post. The point is threefold

- Silver probably still was a sale, but not on that particular system.- Silver Short Autopsy

- Their will always be other trades and bankroll management is key to successful short term trading

- Gold just gave us a signal

Before we get into the signal in Gold we want to give an important caveat. The markets are squaring up for Friday's Yellen-Fest from Jackson Hole. That means liquidation mostly between now and then as smart traders do not like digital/ surprise events like Blabbering Bubble Girls whipsawing the market. Given the Volatility Breakout System's (VBS) description, it makes perfect sense to have movement before the news. It also is not necessarily a directional indicator. So if you are playing this trade, bets are off the table on friday. it is hard to justify using a probability based system on a coin flip event unless that coin is being flipped 1000 times. And G-d forbid if Janet Yellen gets to contradict herself in 1000 more speeches.

And by the way: Still waiting for an answer from BMO on this. Although they did reach out to discuss yesterday. We'd still like to know: At what price does BMO "buy the dip" in Silver?

Gold Signal Today

The VBS system uses Bollinger Bands as its final signal to get into a position. The rest is proprietary and based on implied vol and other assorted correlated mean reverting stuff. All we care about now are the Bollinger Bands. We will spare you the step by step for this. if you want to understand in more detail, click here for the silver trade where we went into much more detail. Just note that we use 1.5 instead of the standard 2.0 in our STD width for metals

Technical Analysis

DEC GOLD Resist: 134610, 1349-135150 ST Trend: Sdwys/ down(134140) Supprt: 133980*-, 1334, 1324- Obj: None TRP: 1359.40Comment: Trade remains caught between 133980* support and 135940* resistance. A close over 135940*rekindles bull trend forces to again reach for 138060*. Monday’s selloff still suggests a preliminarydownturn from congestion. A close under 133980* or press through 1334 implies selloffs to 1324-1320.

VBS Ain't Easy

Using a momentum system is not easy as a standalone tool. We use it as standalone, and as a result miss many bear/bull flag opportunities. Yesterday in Silver for example. Also after a big move as we are seeing in Gold, who wants to short the market here? Not us. Right now we want the market to rally on the close while the BBands remain wider. This will give us a better entry point and would probably look like a little bear flag on an hourly chart. This is a short term trade, and we'd like even more so to be out by Friday 8 AM winner or not.

All the more reason to use this tool as a complement to what you already use in traditional technical trading. Silver was a sale yesterday from many technical perspectives. We just don't like averaging into losers, and are not into selling bear flags or taking home losers. But if you had a short signal on your own system, the VBS would have kept you in. Maybe not until $1784, but certainly for today.

Of Interest

- Trump Calls for Special Prosecutor on Clinton Foundation

- Buy gold if you don't want to end up in tears - Jim Grant

- At what price does BMO "buy the dip" in Silver?

- Technical Brief: Silver defiant, Fischer Fails

- QE Alert? Stocks, Bonds, Gold strong, Vix trashed

Here is the Silver trade we did in 3 charts without comment added. ENJOY

The Entry 7/21-7/22

The Exit

The Agony

Read more by Soren K.Group