Gold and Silver's downside may be capped. Stocks see more slide short term, and Oil is in a definite bear trend. Dennis Gartman exited longs. We can sardonically say this confirms our feeling on oil.- Soren K

Headlines- Trump speaks, Clinton leaks, and China lies

- GBP LOWER TODAY UNDER BREXIT LOWS-mkt discounting QE

- CHINA NEVER TO ENTER A CURRENCY WAR: PREMIER LI.- we peg and piggyback, never fight the war

- Sen. Tim Kaine of Virginia Seen as Clinton's VP Pick - DJN- sponsored by Wall Street banks

- "Americanism, not globalism, will be our credo" - Trump speech

- Full Text of Trump's Acceptance Speech

Technical Analysis

Gold- NTRL. Bear trend may have reversed depending on today's close

Yesterday's activity was constructive and plays into our bigger thesis that as long as Gold remains above 1301 while open interest decreases, then it is a buy on pullbacks. This morning, gold is down $7.00 which mitigates the technicals below the chart, and why we remain neutral on the metal. Otherwise we would be saying buy strength today.

Bottom Line:The short term technicals may change, but the story remains the same. OI will decrease significantly in 3 days. We will see where market is then

Gold Holds as OI Drops- we can live with this

Yesterday's retracement against the outside day 1 day ago hurts reliability for bear follow-through moves.Yesterday's close has penetrated above a key (1328.07) resistance point, implying a trend turn and follow-throughmoves in coming days.

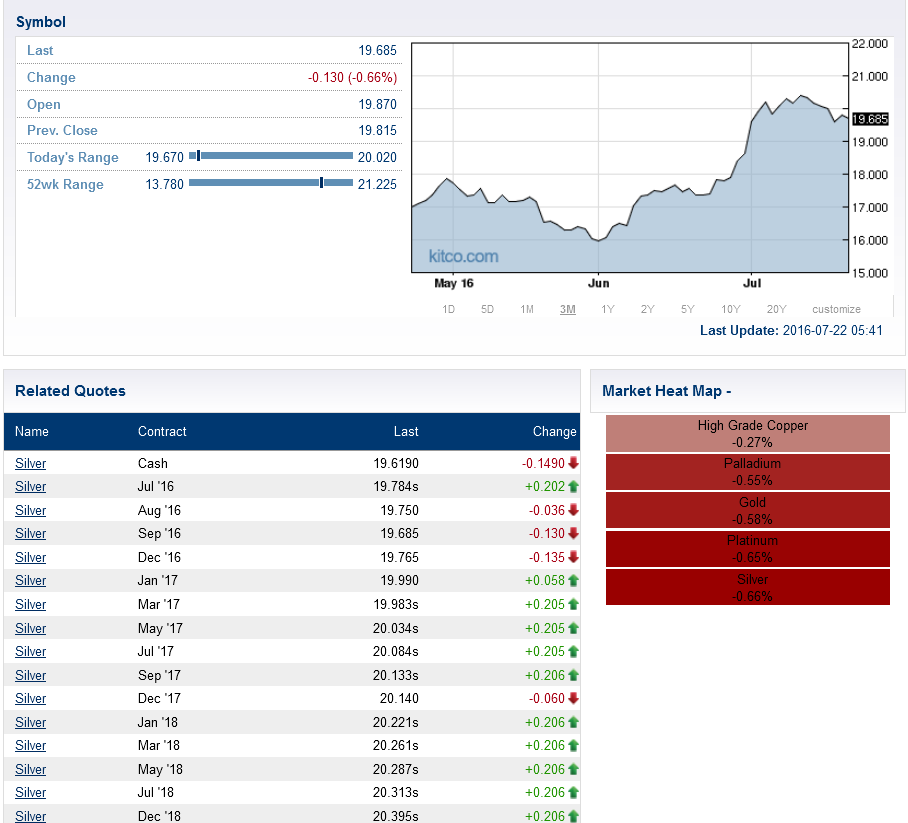

Silver- Range bound

Yesterday's penetration of resistance range levels gives a statistical bias for rallies today-tomorrow. The market is capped at 21.00 for now. Yesterday's activity hints at downside capped as well. As in Gold above, Silver may be in a range until some event triggers the next reaction outside its wider range

-Click Graphic for interactive chart

Dow Jones- More downside imminent short term. Futures are called higher today. We feel there is room to go lower as stated in earlier posts.

The downside objectives for this formation range from 183.17 to 182.37 with a close over 185.00 needed to negate abear trading stance. We are beginning to see that the market, like the SPX is range bound. A crisis will instigate bigger selloffs as momentum lower seems to be choppy without fresh news

Oil- The market has rolled over

We are now below the 50 day moving average and should easily test the 44.20 area. Only a settle above 45.70 or a trade above 46.50 puts the bulls back in the drivers seat.

Market showing a breakout under a previous daily swing low and should quickly extend sell-offs. Failure to extendthe breakout now alerts for a bear failure. A close back over 45.49 signals a breakout failure and turnaround

Parts of the above are courtesy of GRI Technical analysis, For full reports on all major commodities email: support@GRI2.com

Good Morning

-Soren K.

Read more by Soren K.Group