2017 LBMA Precious Metals Forecast Survey

Highlights

Contributors to the 2017 Forecast Survey are bullish across the board for all four metals.

- Gold: Analysts are forecasting that the average gold price in 2017 will be 5.3% higher than the average price in the first half of January 2017.

- Silver: They are slightly more bullish about the prospects for silver prices, with an increase of 7.1%

- PGMs: For platinum, they forecast an increase of 4.9%, but expect a more modest outlook for palladium, with a forecast increase of just 2.4%.

excerpts- emphasis ours OverviewContributors to the 2017 Forecast Survey are bullish across the board for all four metals. Analysts are forecasting that the average gold price in 2017 will be 5.3% higher than the average price in the first half of January 2017. They are slightly more bullish about the prospects for silver prices, with an increase of 7.1%, but less bullish about PGM prices. For platinum, they forecast an increase of 4.9%, but expect a more modest outlook for palladium, with a forecast increase of just 2.4%.

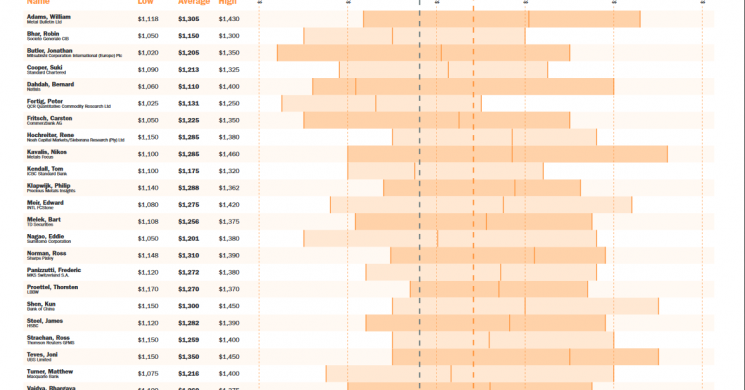

Forecast contributors are predicting that the gold price will average $1,244/oz in 2017, 5.3% higher than the first half of January 2017, but broadly in line with the actual average price in 2016. The analyst who scooped first prize in the 2016 Forecast, Joni Teves, is the most bullish, forecasting an average price of $1,350/oz whilst Bernard Dahdah, who claimed first prize for palladium in the 2016 Survey is the most bearish with his average forecast of $1,110/oz.

2017 will certainly be an eventful and unpredictable year given the high degree of geopolitical uncertainty, with a more nationalistic US President in residence and the indications that the UK will pursue a hard Brexit in its negotiations with the EU. There is also the prospect of further uncertainty with elections to be held later in 2017 in both France and Germany, as well as the potential for tensions between the US and China. Gold

Analysts are predicting that the gold price will trade in an average range of $1,101/oz to $1,379/oz. Greater uncertainty should prove positive for gold as could higher inflation if the new US administration adopts reflationary policies. On the downside are the anticipated three US rate hikes in 2017, a stronger US currency and rising stock prices as well as continued weak demand from both China and India. Silver

Analysts are marginally more optimistic about the prospects for silver prices in 2017. They forecast that the price will increase by 7.1% to an average of $17.77/oz, with prices expected to trade in an average range of $15.13/oz to $20.66/oz. On the upside, analysts cite geopolitical uncertainty and a stronger economic outlook boosting industrial demand (which accounts for more than half of physical consumption); of new solar plants, especially in China is likely to boost demand from the photovoltaic industr y. Negative influences on the silver price include the potential for higher Fed rates and yields, the risk of the Trump administration pursuing a damaging trade policy, as well as potential for a drag on prices given that silver comes into 2017 still burdened with a relatively large speculative overhang from both the ETF and the futures markets. Platinum Group Metals

Analysts are less bullish about the prospects for PGM prices in 2017. Platinum prices are forecast to increase by 4.9% to an average price of $1,014/oz, which is $27 above the actual average price in 2016. Analysts are forecasting that the price will trade in an average range of $865/oz to $1,167/oz. Mine supply is expected to be relatively flat and prices are expected to be dragged around by the rand/US dollar exchange rate and uncertainty in the global economy. Positive influences on the price include expectation of continued strong demand from the auto diesel market, whilst negative factors include potential for higher interest rates in the US and a firmer US dollar as well as the prospect of weak demand from the jewellery sector. In contrast to last year when forecast contributors were most bullish about the prospects of palladium, analysts are most bearish about the price in 2017, forecasting only a modest increase of 2.4% to $762/oz. They expect the price to trade in an average range of $634/oz to $872/oz, with firmer supply and the risk of a slowdown in global car sales keeping a lid on prices. Read on to find out what analysts think are the key drivers likely to influence precious metal prices in 2017.

Full interactive report HERE

Read more by Soren K.Group