The much-anticipated jobs report, expected to have shown 180k jobs were created last month, actually came in nearly 42% higher than expected, and much higher than even the most bullish expectations from economists.

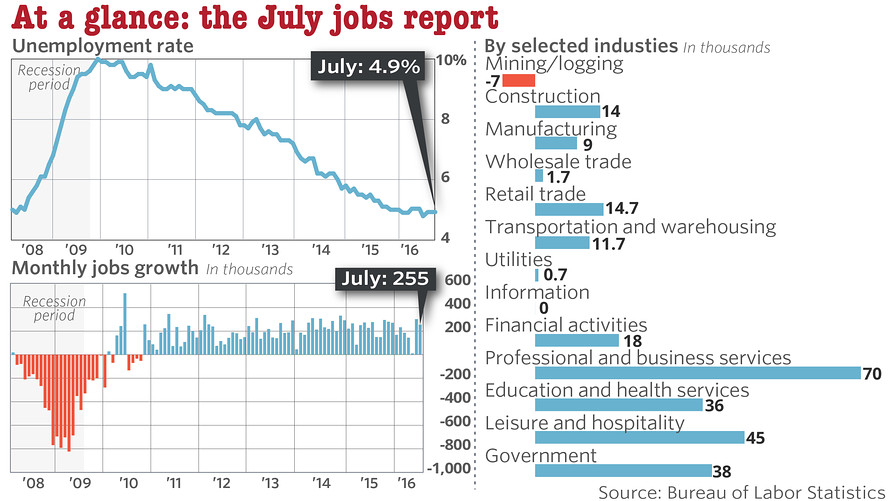

The Bureau of Labor Statistics said that 255,000 jobs were created in July and the unemployment rate came in unchanged at 4.9%. May and June data was also revised higher. May’s numbers were revised to 24,000, from 11,000; June’s employment was revised to 292,000 from 287,000 jobs.

How did investors take the news?

In initial reaction, December Comex gold futures tanked, dropping 1%. U.S. stock markets opened higher Friday on the news. Bond markets sold off.

Dow futures has jumped over 100 points post-jobs, while the S&P has rallied 9 points and Nasdaq is up 23 points.

Meanwhile, crude oil dipped on the news and last traded down 0.52% at $41.71 a barrel.

Some analysts focused their attention on wages, which proved to be a positive in the repor.t

“[T]he resilience of the labor market was reflected in wages and how many hours people work each week. Hourly pay rose 0.3% to $25.69, keeping the 12-month increase in wages at a postrecession high of 2.6%,” MarketWatch wrote Friday. “Every major industry hired in July except for energy companies, which have shed jobs for more than a year because of lower oil prices,” he added.

Now what?

All eyes are on the Federal Reserve and what tone they will take post-jobs. As veteran trader and RBC Wealth Management’s George Gero put it, “the Fed, again data dependent, may actually see the hawkish remarks to fruition this year.”

Read more by Wall St. Whisperer