Top Day: The Fed is Insane

This Recovery Brought to You By The Global Central Bankers. They're Here to help

Market Summary:

Comments in italics

- Bonds are lower worldwide, while the USD trades at 7 month highs.

- Fed will “tolerate faster inflation” because admitting failed policy is anathema to academic bubble people, and they will just use more extreme measures of the same thing. (We said as much in a previous post).

- Oil dropped a little, and has not been retreating with the dollar rally- a war premium is being built in we think.

- DB is pulling in its US operational reigns as its regulatory issues are here.

War premium aside, historically, the last pile in of Oil longs is the peak. How much more can be bet?

Gold and Stock Technicals

Gold

- $1250 is support

- A break under $1250> extreme low blow off alert ($1155?)

- Between $1290- and $1315 is neutral

- Weekly close over $1300 is bullish

- The trade is to be long for risk/reward reasons

- The reversal is in play

From Friday's POST

interactive chart HERE

Stocks

- bearish with bear flags possible first.

- 2147>2127>2090

- rallies under 2147 should be sold currently

Chart HERE

Economist Yellen Will Be Right

- Insanity: doing the same thing over and over again and expecting different results.

- Wu Li: A Chinese term with many meanings. One is " We cling to our ideas"

- FWIW: if the strategy is to defeat deflation, what is wrong with changing tactics toward that end?

Be careful when people trained in a certain discipline start using other fields to justify their actions.Specialists specialize, but unchecked ego does not recognize limitations. We have been operating since 2008 under the premise of a classic logical fallacy used in law.

Post hoc ergo propter hoc- "after this, therefore because of this".

Applied: Since past economic recoveries followed higher stock prices, then economic recoveries must have been caused by higher stocks, right? In practice, this is what happens when Intelligent Yet Idiotic (IYI) people use other disciplines to help justify their continued actions.

- Higher stock prices are a harbinger of economic recovery- true, given free market with Fed intervention at the margin

- Thus higher stocks indicate policy decisions are working- huh?

- yet, the economy isn't showing the signs we hoped for- not our fault

- The people do not understand. Let us help them- uh-oh

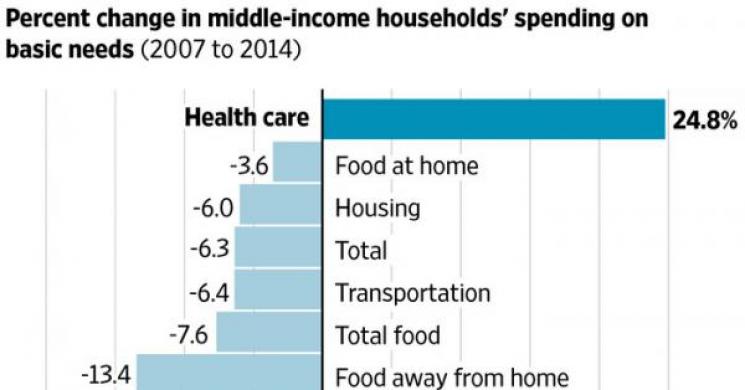

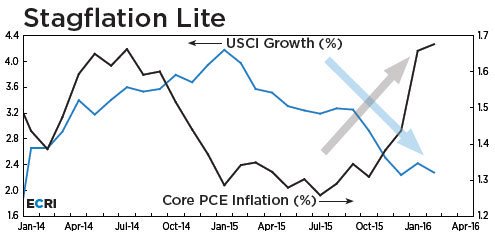

- Fed will “tolerate faster inflation”- because stagflation makes us wrong

- Draghi Seen Embracing More Before Less QE as Inflation Edges Up- ibid

- BOj which just began tapering, is now considering Helicopter money- Ibid

“The interests of a more emphatic economic recovery”

Yellen pondered whether a “high-pressure economy” could boost areas like labor-force participation. Translation: we see inflation, but not recovery. The idea cannot be wrong, we must do more. Given enough inflation, the economy will catch up. Insane. What does high-pressure even mean? We know they don't (can't) make companies hire or lend. Those companies either own policy makers or will just move out of country. Success may be defined as people paying $10 for a loaf of bread before the economy recovers. The Fed will be right, even if it kills you.

Stagflation? Unpossible!

Logical Fallacy Part 2

Correlation and Causation

- Inflation is historically a byproduct of an overheated, recovered economy

- therefore inflation in part is caused by economic recovery

- CTRL - P

Elsewhere

- Meanwhile, Brexit is causing some EU banks to consider moving people to NY from UK- right. We call BS. Global demand is shifting eastward, that’s an appeasement statement. California is a better place for international banking now.

- JPM and Citi topped analysts estimates- clearly they are good lap dogs for the Fed now. When the Fed hits your bid and lifts your offer for 5 years post the 2008 crisis, they are helping refinance a banks on top of the bailouts. Good boy Jamie

- "ISIS Endgame"- (Bloomberg title)-Iraq (read US) started taking action to mosul. With the “expendables' as point of the spear (Kurds and Iraqis) with US air support. End game? What about history makes you think there is an endgame? This is the US doing what it can to save face, not what it has to

- 80 S&P companies report earnings this week. GS among them.- Blankfein still "doing God's work we hope"

Good Luck

Soren

Read more by Soren K.Group