PAPER GOLD, PAPER TIGER

- Are ETFs a cheap and easy way to own gold?

- ETFs offer inflationary protection in orderly market environments

- ETFs do not protect you from theft, counterparty default, or systemic risk

Summary

by Vince Lanci | with cynical contributions by Dinsdale P in italics.

Are ETFs a cheap and easy way to own gold? The short answer is no.

The idea behind ETFs is to give investors a way to buy and sell gold as simply as they would a stock.

Excuse me, but the real idea behind ETF’s was to invent a product that made sure Brokerage firms kept your money from leaving them when you tell them “I want to invest in Gold” and all they can offer you is a gold mining stock.

But the problem is that when you buy GLD or any other gold ETF, you are not buying physical gold.

This is Gold

This is Gold On Drugs- Any questions?

Your Gold can be leased, rehypothecated, moved, and worse if you ever wanted it

Instead, you own shares in an ETF that are backed by gold. ETFs are essentially Closed-End funds in structure. Ever own shares in a Nuveen Muni bond fund? Same thing, different decade.

You mean they painted the turd a different color and called it an ETF

Similarly GLD and other ETFs are tracking stocks of the assets they purport to control. In this case, GLD tells you it has the Gold to back the ETF shares you hold. And where is this gold?

Your Gold is Not yours to Hold

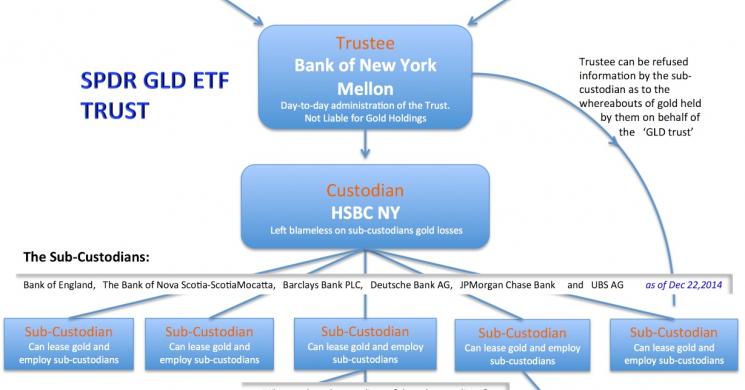

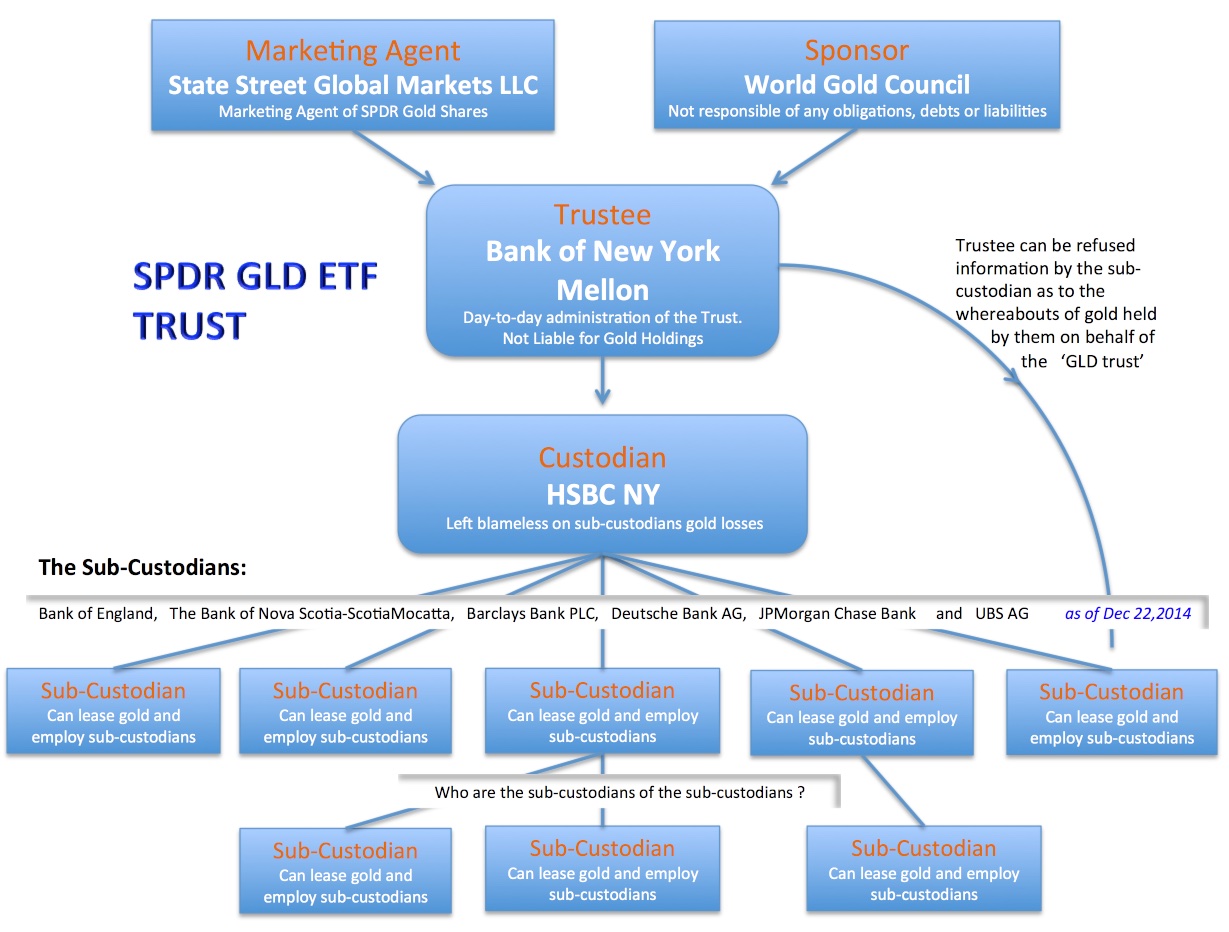

All the gold that backs GLD is allegedly held in HBSC vaults in an undisclosed location in London. How much gold is there? Nobody actually knows, and investors have to take the word of the trustee, Mellon Bank of New York that halfway across the world, enough bullion sits in these vaults to cover GLD's liability.

Think about that.

The actual gold that your share represents is in London controlled by HSBC (the custodian). And the guy you trust to make sure that the gold is actually there in the custodian’s vault is in Mellon bank in New York. Got it. Kind of like you leaving your kids in the care of a babysitter at the babysitter’s house. But the babysitter is somewhere else. And do not tell me there is an electronic audit trail to ensure your gold is safe. Does it have GPS tracking too? Do you really think you will get your gold if either the custodian or Trustee goes under? Ever hear of MF Global? Or the guy who tried to smuggle Gold out of the Canadian mint last month. Or rehypothecation, the fractional reserve banking of Gold and biggest problem if there ever is a systemic crisis

You Do not Control What You Own

However, no matter how much gold it holds, there are no redemption rights by shareholders, meaning you cannot exchange your ETF shares for physical gold. In addition, the physical gold is not required to be insured, which means the trustee is not liable for loss, damage, theft, or fraud. Maybe the custodian is liable?

So the trustee sues the custodian for the gold? Good luck navigating that labyrinth.

When you need it most, the government will need it more

Gold Confiscation- Old School

In 1933, when Franklin Roosevelt came into office, he issued the Emergency Banking Act, which required all those who held gold to turn it into the government via approved banks. The citizenry was given 30 days to comply with this order and were paid the current spot rate of $20.67 an ounce.

Roosevelt allowed some exceptions, such as personal jewelry and collectables, but that was done at his discretion, and there is no guarantee that there would be any exemptions in a future confiscation. And what would be the point of having gold to protect against a catastrophic event if the government can just seize it?

Do you think you will have a snowball’s chance to get your Gold then? Or even the face value promised when the custodian, trustee and various interlopers take their fees for liquidation. But that is crazy talk. Gold will not be confiscated in the US again, right?

Wealth Confiscation- New School

- Forcing Physically settled futures to be cash settled

- Kind of like “liquidation only” which was used to shutdown the Hunt brothers

- Taxing Gold Profits

- This would make it much easier for the government to accomplish something similar to its 1933 heist.

- In 1980, Congress passed the Crude Oil Windfall Profit Tax Act, which taxed up to 70% of “windfall profits” of domestic oil producers.

What the heck is a windfall profit anyway?

As far as I can tell, it’s whatever politicians decide it is. It’s completely arbitrary. There are no objective measures to define it. In short, a windfall profit is simply a profit politicians don’t like. The whole concept is a scam—a word trick to camouflage and sanitize legalized theft.

If the price of gold explodes, I wouldn’t be surprised if Congress passes a Fair Share Gold Windfall Profit Tax Act levying a tax of 80%, 90%, or more on gold profits.

Why We own Gold

If you own Gold, you own it to mitigate one or more of several risks

- inflationary hedge- obvious

- Systemic risk- by virtue of it not being in the system and subject to parlor tricks and electronic transfers it is difficult to "lose" in the legal shuffle. If you actually have it in your possession. Gold is economic freedom.

- Counterparty risk- as the only money that does not have debt attached to it, why would you let someone else control it for you? That creates the counterparty risk you seek to avoid

ETFs: The Bottom Line

Trade Gold ETFs if you must. But you are deluding yourself if you think that ETFs and possibly even Gold futures will be permitted/ able to actually deliver physical Bullion when you need it most.

Here is the trade to take advantage of the potential disconnect between Bullion in your possession and paper promises of bullion at a later date. It is what corporations do.

- Be long and in possession of physical Bullion

- Hedge price risk with paper future shorts or ETFs

- You now own the optionality in a crisis that all the corporations do

- if the counterparty of your short paper goes under, you lose part or all of your liability

- if you find yourself in financial crisis and cannot cover the margin or deficit from a move higher on your hedge- default. You still have the gold

- if the government taxes Gold or worse confiscates it: your hedges will go down, but your Gold can be moved to a country that will give you fair value for it

We are not advising a person to break the law, avoid paying taxes, or otherwise unethically defraud on its contracts. We have associates with Gold holdings in Europe, Canada and Australia. All physical. All in vaults the control or own, and all declare sales and profits for tax purposes. These are patriots.

But lets be crystal clear. Corporations have all the rights of humans and none of the social contract and ethical obligations that humans bear in the form of a conscience. Time to be like them. Time to be free economic agents.

Baseball Free Agency as Analogy

Remember when free agency started in Baseball? That was the "people" responding to the team owners not having to be loyal to players and even their cities. Teams left for tax deals and player loyalty was rewarded with being traded like cattle in the pursuit of dollars.

And free agency was the players extricating themselves from the systemic risk. It was them protecting themselves. In the end, it was players becoming just like the teams they played for.

Teams declared free agency the moment the Brooklyn Dodgers moved to LA. No social obligation hindered that decision.

So why should players be sentimental about their team if their team had no loyalty to them? Protect yourself.

All we are saying is: Be like the banks that own and control tons of Bullion, and are short paper contracts to deliver that bullion. Be like the Brooklyn Dodgers. Don't be the loyal player who gets killed in the reshuffling of our financial world.

The holder of the bullion controls the option. Control is more important than ownership if history is any lesson.

"They seem to sense - that gold and economic freedom are inseparable, that the gold standard is an instrument of laissez-faire and that each implies and requires the other."- A. Greenspan 1966

Be a Patriot. Protect Your Family's Future

- Declare free agency from the system's risks by protecting yourself with Gold as a piece (not all) of your financial holdings

- Don't use ETFs as an investment vehicle. That is subjecting yourself to the same exact risks you seek to avoid

- By owning bullion and hedging risk responsibly in paper gold, you own the embedded option that accompanies any contract.

- If the counterparty goes under, you will not have to make delivery in full. There will be a haircut for sure

- if you are financially insolvent and are forced to declare bankruptcy, you again control the asset while the counterparty must take a haircut

How do you hedge your Physical Gold or Silver? That is not easily done. it involves a counterparty trusting you. And improperly done is a swap of price risk and system risk for bankroll and VAR risk.

Selling calls, buying puts, selling futures, whether to use leverage or not.. all tools that are dependent on the person looking to hedge risk or create a dividend on their Bullion holdings. And don't get me started on so-called covered call ETFs. One size does not fit all. People are not commodities and individual needs must be factored in. These things demand hands on personal attention.

If you use ETFs just go in with your eyes open. They are tracking stocks for Gold. And are subject to the same shenanigans that corporate CEOs have been doing forever to stock holders.

Be Well

Vince Lanci

More on Confiscation and Manipulation

Read more by Soren K.Group