UPDATE 12/01

Yesterday, Donald Trump's Sec of Treasury Appointee Steve Mnuchin stated longer term treasuries were on the table.

“Interest rates are going to stay relatively low for the next couple of years,” Mnuchin said Wednesday in an interview on CNBC. Among other initiatives, “we’ll look at potentially extending the maturity of the debt, because eventually we are going to have higher interest rates, and that’s something that this country is going to need to deal with.”

Asked if he would consider maturities as long as 50 years or 100 years, Mnuchin said: “We’ll take a look at everything.”

In case you are wondering, that is inflationary. Permanent monetization of debt is never paying the bill back. So even if no new debt is issued (but it will be), the government intends to roll the maturity of current debt further outward. This will be at a higher interest rate. This is what we have been talking about. Trump will use fiscal tools to spend more money. That means, deficit spending, tax subisidies for coporations, lower tax revenue, higher individual taxes, higher cost of living. The helicopter sounds nice, but it isn't coming to your house. It will in the end, rain money on corporations. It will be a debaser of the USD, and a domestic tax on the people in the form of inflated good prices.

On November 15th, we outlined the case for a 1970's style inflation returning. Mnuchin's statement is our first real confirmation of that thesis. Here it is restated. We hope you find it informative- Soren K Group

First, "Helicopter Money" as it has come to be defined:

Although the original idea of helicopter money describes central banks making payments straight to individuals, economists have used (twisted) the term 'helicopter money' to refer to a wide range of different policies, including the 'permanent' monetization of budget deficits which is nothing else than the old-fashioned idea of debt monetization – with the additional element of attempting to shock (dissuade fears) beliefs about future inflation or nominal GDP growth.- Wikipedia

The Playbook for the 1970's

Bonds down >Stocks up > Non-reusable Commodities up > Dollar down >Stocks down > Gold up

Original Piece

The following is a collaborative piece between several Traders and Bankers.-Soren K.

Welcome to the 1970's

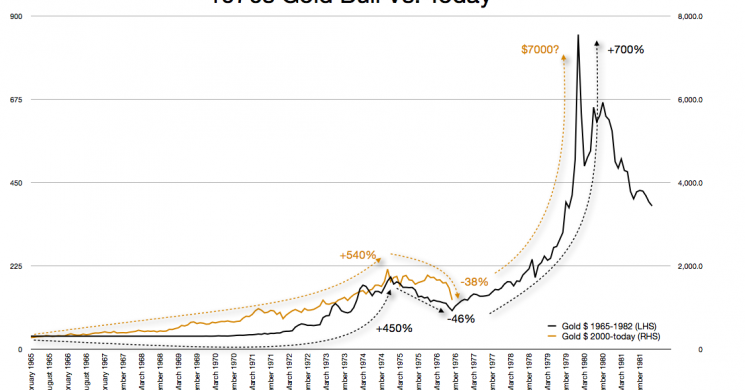

The blue area represents how gold behaves in negative real rate environments. Note how it has done compared to the 1970's. Gold has actually gotten ahead of itself. The price reacted much stronger vs. real rates recently than it did in the '70s. That is because we had inflation in the 1970's concurrent with the negative real rates. And that is because the Fed chased inflation then and will have to do so again now. Imagine the behavior of Gold as negative real rates continue (they will), and we actually get inflation ( we are). The yellow rock never should be used as a predictor of inflation. It is best used as a reactor to inflation. Hedge funds did this to Gold. Our conclusion is that Gold will rise even more so when the actual inflationary mess starts. We try to make that case logically below-SK

"Markets have essentially superimposed Obama-level rational stability onto new political structure and policy projections."- Matt Busigin

“Some markets are reacting now, some are predicting. Those that are reacting like gold are going to be the opportunity. Those that are predicting, like bonds are the compass.”- SK

Making Sense of Investment Markets

Gold and Silver are as they were; a diversification of monetary risk. There will be a proper rally. It will be slow and orderly. We personally do not want volatility to the upside. Let it sleep and slowly climb without funds piling in it prematurely. And if you are in a position where you have to sell Gold, then you had too much to begin with. A properly balanced portfolio should never sell Gold outside of a re-balancing of its allocation percentages, global macro crisis excepted. We hope the following collage of concepts helps the reader to see the rationale. But first, a reality check.

This Chart Disagrees

The chart above shows one of the nastiest outside bearish bars ever seen anywhere. Are we in denial? No. As traders, this is a nice set up for a short side market bias. As investors, we will start to look for a rounding bottom, wherever that may be to stop playing the short game, and start adding to inflationary longs.

Real Estate as an Inflationary Hedge

You should have 5-10% of your assets in specie at all times. And do not bet on your home as an inflationary hedge this time around. Even if your home isn’t already overvalued (talking to Canadians, and US Northeasterners), you will not be able to get cash out of it in an emergency. You will not be able to put it in a bag if a crisis comes and you have to move. We can virtually guarantee that in some form, home price increases will be self-defeating. There is precedent in many countries for this.

China's Gameplan Summary: Buy Stuff, then Debase (repeat)

China bought physical assets in part with their Treasury sales proceeds recently. Those copper buys and bond sales will be good in a few years. What did they do after their shopping spree? They weakened the Yuan, just like post- Brexit.

The Chinese need to keep the exported deflation of emerging markets out of their markets. And now that they are part of the SDR, they can start to let their USD peg slip a little more. Inflation is the way out of debt once the deflation monster is killed. The US Government has to inflate for its own survival. The USD may be the last to debase, but it will in a big way when it finally does. The Chinese know it. And it is not crazy to protect your biggest creditor's (China) exit as we have been doing for years, before letting the bottom drop out of your own Bonds. China and the US are co-dependent. Neither government will be left holding the bag when all is said and done.

The U.S. Slow Default

You Still can't Eat Bonds

Inflation is a slow default on debt. The key is to keep it controlled. The bag holders will be emerging markets that are selling their own currency for USD seeking to remain competitive in exporting their raw materials. That is possibly why you see their stock markets droop even while their currencies are weak enough to encourage export. But the 3rd world is that for a reason. They are not invited to the party. They will be the first to go, and the last to know, always. They are short dollars as it rises. They will be long dollars when the US starts to debase. And China will already be out. The Chinese have cut dollar based commodity deals all over south America, the Caribbean, and Africa. Smaller countries will remain poor. As class movement has become restricted in the US, so shall it be in world economies.

Governments Only Care About Themselves

The US Government has expanded its balance sheet to buy bonds. Next it will buy stocks we feel. Finally it will (if it isn’t already) buy things. Things like Oil and Gold. Of course the Government won’t announce they are buying Gold or Wheat, or Oil. But they will directly or through subsidized proxies. Expect CPI to get adjusted even more. Government books are cooked all around. We're just getting started on that concept here, and hope to show more in the months ahead.

The People Will Bear the Burden

“The American Republic will endure until the day Congress discovers that it can bribe the public with the public's money. Life is to be entered upon with courage. Americans are so enamored of equality that they would rather be equal in slavery than unequal in freedom.”

Will the public be invested in the things the Government buys? Doubtful. But the public will be the ones paying higher prices for finished products in the end. You will bear the burden of our government unloading its debt indirectly but with much pain. The Chinese method of de-dollarizing has already shown us the template for the US government puking its own inflation risk onto its populace when the time comes. In the end, the masses will bear the burden of the machinations of Fed fantasy. So, Gold is never a sale as long as you are paid in dollars and have stock market exposure.

Bonds First, Gold Last to the Inflation Party?

You have to be nuts to sell Gold as a part of your portfolio. If you have the proper allocation of Gold to stocks, then last week should have been a good week for you. Speculation is a different story. But when stocks go up and Gold goes down, be happy. Bonds? In a normative market, Bonds predict, Stocks predict less so, industrial commodities react in real time, and Gold lags.

Bonds are discounting 2 years down the road again. That is because the government is not going to be manipulating them with QE we feel. That is your compass to know that gold will do well in the future. The key for you as an investor is to keep rebalancing your portfolio as stocks rise and Gold drops.

What Follows are observations of the last week that those conclusions are based upon by asset class.

Bonds Routed Globally

- Yesterday U.S. 30-year Treasury yielded 3 percent, a level last seen a year ago. The global bond market rout continued post the U.S. elections-

- Today, Bonds found a bid (10YR 2.20 this morning), however short lived that may be given that many governments prefer a steeper yield curve to help their continued bank subsidies.

- This being because banks borrow on the short end and lend on the long end of the curve.

- We should consider picking a spot to sell the bounce

US Stocks Benefit, Emerging Markets, Not so Much

- USD strength should undermine US stock prices and help buoy emerging market equities. It has not.

- US stocks enjoy a bid post-election, while emerging and commodity based economies’ stock markets have been dumped on.

- This likely has several drivers, part of which is tied directly to international cash flows, part a function of inflationary fears, and part a direct perception that stocks offer a better risk reward than Bonds

The Rotation out of Bonds and Into Stocks

Domestically

- We see a rotation out of bonds for a simple reason: the U.S. will simply borrow money going forward. A trump administration would inflate the economy via fiscal stimulus. That means while the current printing of money will continue in the form of new debt issued, it will not involve the subsequent purchases of that debt in the QE tradition. Therefore, long bonds are a sale as the curve steepens.

Internationally

- Foreign holdings of treasuries have decreased, led by China. Did they sell bonds and convert to Yuan? No. That is evidenced by the continued weakness in Yuan. They rotated out of long treasuries and into shorter cash instruments or stocks.

The Rotation into stocks has several valid drivers:

- Stocks are a logical asset to put that bond money in as they will keep pace with inflation somewhat. We could go back to the Weimer Republic or show pics of the Zimbabwe 1Trillion note as examples, but there is a cautionary tale happening right now in the UK

- This year’s best performing stock market, the UK’s FTSE is its worst in constant currency terms. Translation, the GBP weakening has sucked all the real gains in British stocks dry. We view the UK as the template for the end game in much of the developed world.

- Trump’s de-regulate, de-tax, and de-velop policies are good for the financial industries on several levels. Other than the obvious benefits of lower taxes and less regulation, who do you think will be loaning money to those developers of infrastructure? Banks will be, and at a higher profit margin due to the steeper yield curve

- Front Run the Fed- If governments decide to expand their balance sheets again it likely won’t be through bond purchases as much. It will be more likely through equity buys. The trial balloons have been floated, some countries are already buying stocks.

The Fed and the Dollar

The Dollar will be the focus of a seemingly confrontational Fed-Trump scenario. Reality is the Fed will control the USD descent while Trump spends.The end will be: China is out of its US Treasuries, the Emerging markets will be long them, the Dollar will be weaker, and the yield curve will be much steeper as the Fed chases inflation almost purposely. US citizens will pay up for food.

Trump and Fed are Frenemies

Much is already being made of how the Fed will be at odds with a Trump administration’s plans to fiscally spend. We don’t worry much about that. Checks and balances are what it is all about. What the Fed will do is seek to counterbalance spending and maintain an orderly ascent in long bond yields by raising short term rates. Those raises will bring some rotations back into bonds and out of stocks. But make no mistake; those rotations are likely short lived because the die is cast.There is only so much short term rate hikes can do to offset long-term bond yields. Especially when the government is no longer buying its own bonds but continuing to print money to satisfy Japan's and the emerging markets' insatiable need for USD liquidity.

The USD will Remain Strong Until We Open our Swap Windows and Everyone Gets Long.

Government is Never Proactive

We think most importantly, the Fed is a “chaser”, or reactor to things. Not a pre-emptor. A big reason for that is job security. It will chase inflation up just as it has chased deflation down. It will react in half measures to be careful.The most important thing from here is this: Real Rates will likely remain negative for a protracted period of time acting as a reason to own stocks, and later on, Gold.Only after things have gotten away from the Fed will someone come in and really put the brakes on inflation. Volcker 2.0 is our guess.

Trump is The Howard Stern of Politics

"Screw them. If they Won't let Me in their little club, I'll make my own and burn theirs down" - - The Angry Outsider

It is important to note that Trump is truly an outsider. But that was not by choice. He always wanted to be the “man”. Now he will get his chance, to be the ultimate insider. He is a lot like Howard Stern in that way. If you ever listened to Stern, he constantly railed at those who would not acknowledge his greatness. He was desperate for acceptance. He made his living off of deriding the group he secretly wished he belonged to, meanwhile he called himself “The King of All Media”.

And what happened to Stern post American Idol? His acceptance dissolved his mainstream hate. We think Trump is a lot like Stern. A man who tried to be a part of the elites, but was not allowed to be. The result in both Stern’s and Trump’s cases were, populism, venom at the establishment, self promotion, hyperbole, and even trailblazing ideas to ironically be co-opted by the groups that would not have them.

In the end, acceptance brought assimilation for Stern. We think it will happen here too. Witness his first choices for cabinet. Trump picked Reince Priebus, RNC Chair as chief of staff. He will no doubt pick a Wall street insider for Treasury head. The man wants acceptance.

“Populism and Railing against the establishment is a good way to get elected. It is not good for governing. Expect to Be Disappointed"

The question unanswered is how does all this matter for Gold and Silver? We believe it matters a lot. If we had to ignore everything and look at one single indicator, it would be the Bond market.

Gold and Silver

Bond Vigilantes Return

"We think that there's a significant likelihood that we have made the 30-year top in bond prices."-Ray Dalio

Precious metals will enjoy the rally they are owed. Inflation is already here in all but name. As assets benefited during QE, they will benefit less so from effectively unwinding QE. The unwinding will come in the form of the US simply issuing new debt, and not buying it back as it did during the QE era. Then there will be extra spending. Bonds are a sale, even if the Dollar remains stable. And that means real rates will still be negative. Which means Gold is a hold.

Fiscal Stimulus

The extra spending, or “helicopter money” can be done in several ways. Its stated goal is to “get money to main street” as opposed to wall street. That can happen in various ways, from tax rebates, to pay raises, to banks loosening small business loan standards. But it will all be backed by more government debt being issued. It has to be. Where else where they get the money?- Sell Bonds

One Example of Potential Helicopter Money- Lower Corporate Taxes

If the above combines a lowered tax rate with closed loopholes it is egalitarian in that what advantages big business had over small businesses is reduced. So Goldman Sachs gaming out where the S&P could go based corporate tax reform is valid if incomplete.

But all ways have the same effect. Technically Helicopter Money is “the permanent monetization of debt”. Simply put, “We ain’t repaying the debt except with more debt.”- Sell Bonds

1970’s Redux

Helicopter Money is not new at all. In fact it is the mechanism we used to finance the Vietnam war; Deficit spending to finance the conflict. Pay raises and tolerated union strikes to placate the people. And they will be again. You will start seeing strikes soon.

And remember what happened after the Vietnam war. It took years to stop the inflation caused until finally Volcker stepped on it. And after that, unions were no longer tolerated, and job insecurity rose. Volcker. We are nowhere near this part happening. Right now the economy is just at the beginning of its “Vietnam war” phase.

Good Luck

Read more by Soren K.Group