DeutscheBank Argues Against QE...and for Helicopter Money

Overview

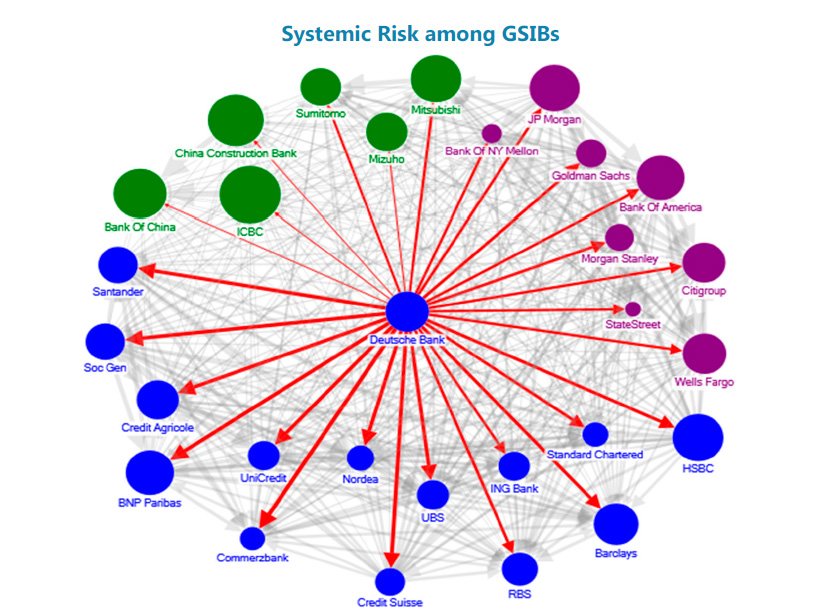

Deutsche Bank, the systemically risky bank that is:

- being investigated by the DOJ,

- has settled with tacit admission of manipulating Gold and Silver prices,

- and is in need of a capital infusion

just wants to help us.

To be fair, the QE piece below is a good one. For us, the take away is:

- unintended consequences are dwarfing the desired ones.

- marginal utility theory is quite applicable

- the system is too complex to be effective

QE Bad-DB

In their recent report below, they educate us on the dark sides of QE. Things like "malinvestment", white collar socialization, hurting savers and other things Captain Obvious forgot to tell us. One could derive from this that DB is extolling the virtues of fiscal responsibility. Prior evidence points to an opposite conclusion. A couple months ago, DB gave an elevator pitch on abandoning QE in favor of Helicopter Money. Taken together, they want an escalation of stimulus, just in a different flavor

Thanks guys

Meanwhile, at end of August, the same bank argued in favor of adopting helicopter money over QE to get the economy going. The reason?

- People are used to QE and thus accepting of it. So it wont work

- They are scared of what they do not understand, like Helicopter Money. So it will work

This sound to us like we should forego our ignorance and just do it anyway. More so, we should let DB show us the way. The people are dumb, the bankers are smart. Especially when their mistakes are borne on the backs of the public. Japan's been promising to raise rates for 10 years. Here is the audit trail

Helicopter Money Good- DB

- We have evolved to the point where familiarity with QE breeds acceptance, while unfamiliar ‘helicopter money’ policy, unfairly breeds contempt.

- Compared with the scale of QE liquidity dropped into financial institutions, piling up in the form of excess reserves, the exante and expost calibration of Helicopter money can be considered almost surgical. Helicopter money legacy issues are miniscule compared with the QE overhang of liquidity in the system, and a costly and bloated Central bank balance sheet, which is so difficult to reverse.

- QE forces a substitution into riskier assets, which is another way of saying it inflates and distorts the price of risky and less risky assets, with implications for all balance sheets, and inter-temporal economic decisions. Helicopter money is less likely to distort every asset price in the economy, when compared with deliberate financial repressive policies like QE and negative rates.

- One of the big criticisms of helicopter money is that it is open to political abuse and that the coordination of fiscal and monetary policy, threatens Central Bank independence. This is less of a worry if there is a clear institutional framework whereby the Central Bank has the final say on whether to participate in any helicopter scheme or not, and they can ‘right size’ the stimulus.

- If one has to be cautious about Helicopter money it is less about whether it can be successful, and more about how in these times of excessive demand management, any effective tool is apt to be used to the point of abuse.

- Helicopter policy that successfully supports growth (with contemporaneous rightward shifts of the IS and LM curve) inclusive of favorable multiplier effects, will likely temporarily drive nominal interest rates higher, and the question for real interest rates (that with nominal rates is a key FX driver) is whether inflation expectations rise more rapidly than nominal rates.

- Carefully calibrated and contained Helicopter actions, by an independent and historically credible Central Bank (not an oxymoron), would likely have a contained impact on inflation expectations. This is especially true, if Helicopter money is pursued in emergency deflationary circumstances. As such, any initial kneejerk selling of a currency when a G10 country pursues a measured Helicopter solution that is befitting of its large disinflationary output gap, is likely to be a medium-term buy the currency dip opportunity.

- Because Helicopter money is less directed at using currency weakness as a core transmission mechanism than QE or particularly negative rates, Helicopter money should be more, rather than less acceptable to an international community worried about currency wars.

So what is it? An escalation of stimulus by different means? Or does the bank's research department have a moving target philosophy?

Really, who is bitterly clinging to their dogma now?

Good Luck

Read more by Soren K.Group