EXCHANGE NEWSWIRE, August 31st, 2016

About ERDesk. We are Clients- SK

A Comment on one item in the Post First

The Index Bubble is another road to creating passivity in Investors even while it serves to weed out poor active managers-SK

H/T Josh Brown

To our point:

I’m making my way through the Sanford C. Bernstein research piece that everyone is talking about today, in which the sell-side brokerage compares passive investing to a combination of Nihilism and Marxism- Josh Brown of Thereformedbroker.com

Inigo Fraser-Jenkins:

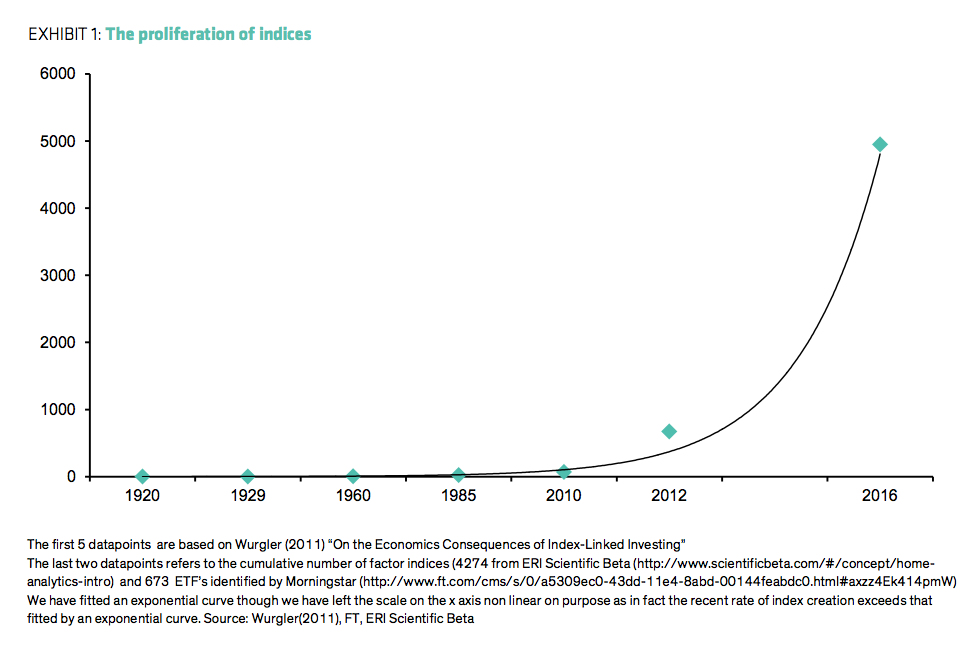

We now have the bizarre situation that there are more indices than there are large cap stocks, this is not at all helpful for investors.

EXCHANGE NEWSWIRE, August 31st, 2016

courtesy of ERDesk.com

Equity Research Desk provides fundamental analysis of global capital markets firms.The coverage includes mutual and publicly-listed exchanges, brokers, trading platforms, asset managers, data providers and other intellectual property assets in equities, fixed income, interest-rate, currencies and commodities across the US, Europe, Asia and Latin America.

CHX plans a 350 microsecond speed bump for traders taking liquidity; according to Bloomberg.- an admission of Latency arbitrage's existence and an unfair marketplace- SK

EU Commission and EU Council authorities said Basel lll regulation refinements bust be subject of deep analysis and scrutiny.-In Basel III's language, gold's liquidity "haircut" is increasing to 85 percent from 50 percent. This percentage is used to help calculate a so-called liquidity buffer known as the net stable funding ratio (NSFR) that all banks must hold from 2018. The higher the figure, the more funding is needed to meet the overall NSFR requirement. This is the last we heard in late 2015. And it makes sense when you consider that the EU needs Greek and other BBB bonds supported at 100% collateral to not let Gold compete. Even while EU banks are buying Gold- SK

Tadawul: Saudi Arabia is loosening rules on foreign investment, according to Bloomberg. Overseas funds with $1bn under management will be allowed to invest in Saudi stocks, down from the current threshold of $5bn. Individual foreign investors will be allowed to own up to 10% of a company. Sovereign wealth funds and university endowments will now be allowed to invest. Also, qualified foreign investors will be able to take part in IPOs starting in January. Tadawul will align its settlement cycle for share trading with global standards by the end of June.

SEC: Google and Amazon are bidding to help the SEC build the Consolidated Audit Trail via their cloud services- Chinese Hackers giggle , Bank flow traders get jobs at Google- SK

JPX outlined blockchain clearing and settlement issues in a new paper. JPX also said that clearing and settlement are the most important use case of distributed ledger technology. Reported by FOW.

DB1: STOXX launched the EURO STOXX 50 Multi-Asset Momentum Risk Cap Indices. These indices implement a cross-asset strategy concept based on the EURO STOXX 50 and the EURO STOXX 50 Corporate Bond Indices.- more indices is what we need-SK

NDAQ: Dorsey, Wright & Associates (DWA) will assume sub-advisor responsibilities of the AdvisorShares WCM/BNY Mellon Focused Growth ADR ETF. The fund will be renamed as AdvisorShares Dorsey Wright ADR ETF, and will retain the AADR ticker symbol.

FX brokers not ready to implement noncleared margin rules will be forced to cut off trading with dealers in US and Japan on September 1. Reported by Risk.net.

Popular On MarketSlant

- Technical Brief: Get a Grip- SK

- If Gold Eats its Dinner- it Gets a QE4 Treat-SK

- He Stands So You Don't Have To- Goldzilla

- The Fed Can Raise Rates 10x in a Row- and other Yellen fantasies-SK

- The Answer Key on Rates and QE4-SK

Good Luck

-SK

Read more by Soren K.Group