GDX a Buy? Not so Fast

Brokers and investment advisors often tout gold stocks as a better way to invest in Gold. Here are some things that brokers tell you about Gold stocks that help you to decide.

They site the fact that: Sarcasm in italics

- Gold mines outperform Gold in a rally- Correct. Almost always, except when they don't (How do you mean?)

- Gold mines underperform Gold in a washout- actually they usually don't tell you that

- Miners outperform Gold frequently due to their financial leverage- nope, they usually don't tell you that either

- Some mines outperform from not hedging at all- and some overhedge.-Wait, what?

- Others benefit from something called Operating Leverage- doubtful your broker even knows what that is

Stock Brokers Want to Keep Your Money Right Where it Is

The reality is that any financial consultant/institution pitching you gold stocks when you want Gold exposure is for your portfolio is usually woefully ignorant and incentivized to sell stock to you, not futures. Keeping it simple, he gets paid more on stock sales than he does from futures orders. And his firm makes more money as well. Seriously, why do you think they even invented ETFs (do not get us started)? In order to keep investors seeking Gold exposure from taking money out of their equity accounts and putting them in FCM accounts. Or worse, buying physical Gold which does not stay in house for them to churn, loan, margin or otherwise monetize while you sleep.

So, why exactly did the GDX fall so much more than Gold yesterday?

GDX: Not a Buy Relative to Gold, and likely not a buy over the next 20 days except as a shortterm trade.

The Reasons Why Gold Stocks Underperform Futures in a Fall

- Financial Leverage (start up)

- Under/Over Hedging (all mines in production)

- Operating Leverage (increases with mine size)

So, if you want leverage, just buy $10k in Gold with $2k in cash. At least the person atteh wheel will eb you and not some CEO whose judgment is non verifiable. And no, ETFs are a horrible alternative. If the point of owning Gold is to avoid counterpary risk, then why would you hold a piece of paper on GLD promising you Gold on demand. When you want it, you will not be able to get it. More on that sham of a product in a subsequent post

For now, we ask that you consider the following info as it pertains to the GDX and Gold stocks in general:

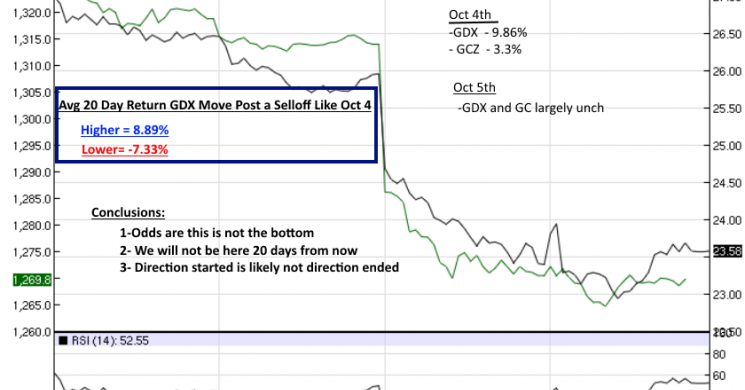

- The GDX sold off 9.8% yesterday

- Gold Futures dropped 3.0% yesterday

- This alone does not make the GDX a buy relative to Gold

- Even if it did, you'd be smart to sell Gold and buy the GDX for an arbitrage- which we do not advise

interactive chart HERE

- Technicals: $1290 is a Line in the Sand, Here's THE Line

- EXCLUSIVE:Judge Orders Gold Manipulation Case Valid

Why Yesterday's GDX Selloff was Significant

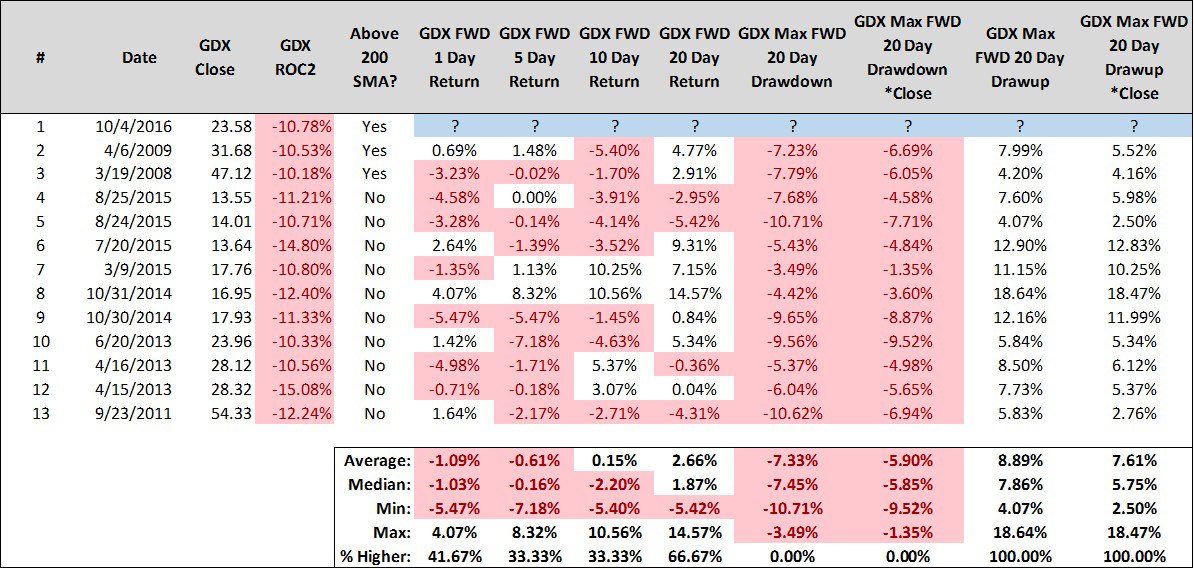

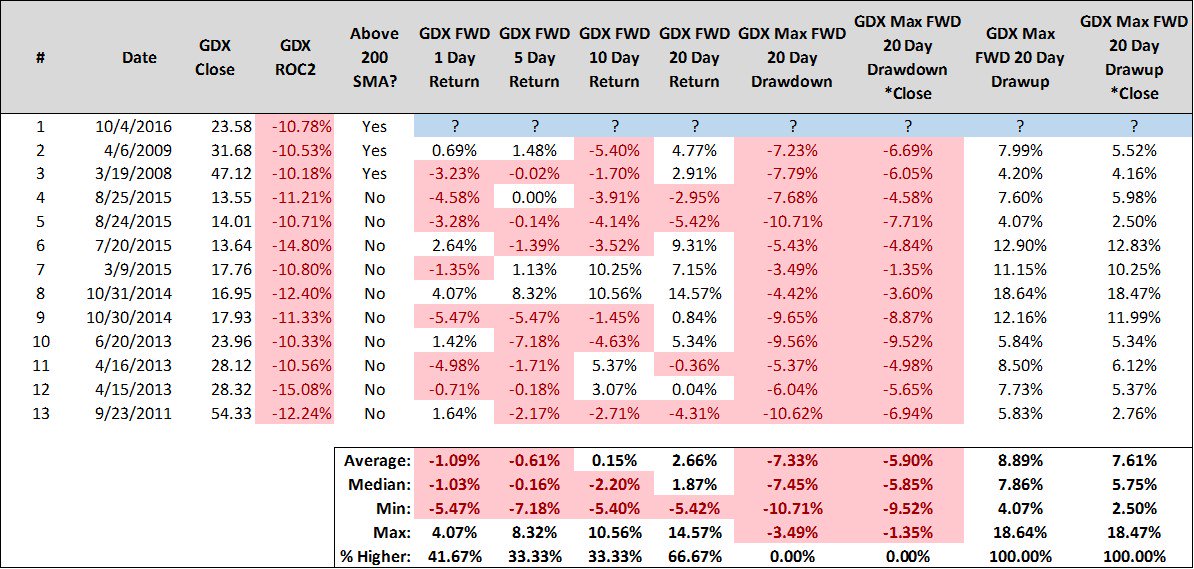

- Yesterday the GDX was down 9.86 %

- That is the worst single day performance of the index while above the 200 DMA since inception

- It was the 9th worst drop historically on record overall

Since yesterday's drop is a rarity, it makes sense to look at the market's performance in the aftermath of such a swoon.

GDX Behavior after Selloffs Fitting the Above Parameters

- Massacres like this almost never signal the bottom of the index

- History says that GDX prices will be lower at some point 20 days from yesterday

- When the market drops is not known but conviction of a selloff follow through is very high

- The market may rally first, only to drop with in the next 20 days

- The market may sell off more, and that can be a bottom signal to buy

But, when an index such as the GDX does what it did yesterday, it presents a rare trading opportunity we call "First way, wrong way"

Over the next 20 days we can say with a high degree of confidence:

- The low is not in yet

- If the market continues lower, look for an opportunity to buy it for a trade- maybe an RSI non confirmation on a new low?

- If the market goes higher first, then look for some level to sell- maybe a resistance point in a 3 day bearflag?

Here is the analysis again that backs the statements above. Compiled by @SJD10304 who we strongly recommend following for charts, and probability analysis in all markets.

Good Luck

Good Luck

Soren K

Read more by Soren K.Group