We believe volatility and global credit risk will force the Federal Reserve to be on hold for a rate hike in March and for that matter the rest of the year. Credit risk will veto the Fed’s desired policy path, take the steering wheel out of their hands. When the market realizes this, the dollar will fall and commodities will surge”.- David Tepper January, 2016.

In the increasingly co-dependent world of Central Banking- The BOJ may lower rates again, but reduce its buybacks of JGBs and steepen the yield curve. If they did this, and we were fortunate enough to have their announcement come out before the US Fed announcement, we could very well see the rate hike the Fed wants so deperately before they have to do the next round of QE- Vince Lanci- Sept 19,2016

Background

Before going into the data preceding this weeks BOJ and FOMC meetings we'd like to dig up our thought process for what we think is likely to happen in Global FedLand.This is where we stand right now on the potential for a rate hike as it fits into the bigger picture of more QE, more stimulus and more NIRP. For what it is worth, we have a Silver investment add-on bid in the $18.00 area in spot.

Assumptions:

- The Fed needs monetary bullets in case of a crisis- thus it must hike at some pint (per Janet Yellen)

- The USA will be the last to stop exporting its deflation and therefore the last to truly debase its currency via helicopter money.

So how can one expect a rate hike if in fact one believes that another round of stimulus is on the way? How does the Fed get bullets in its gun so ti can use them during the next crisis?

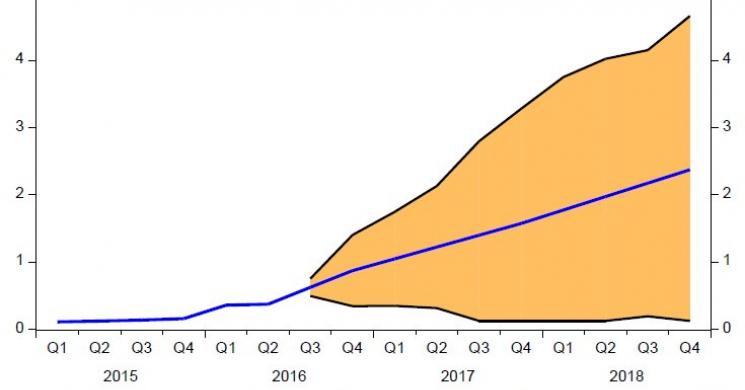

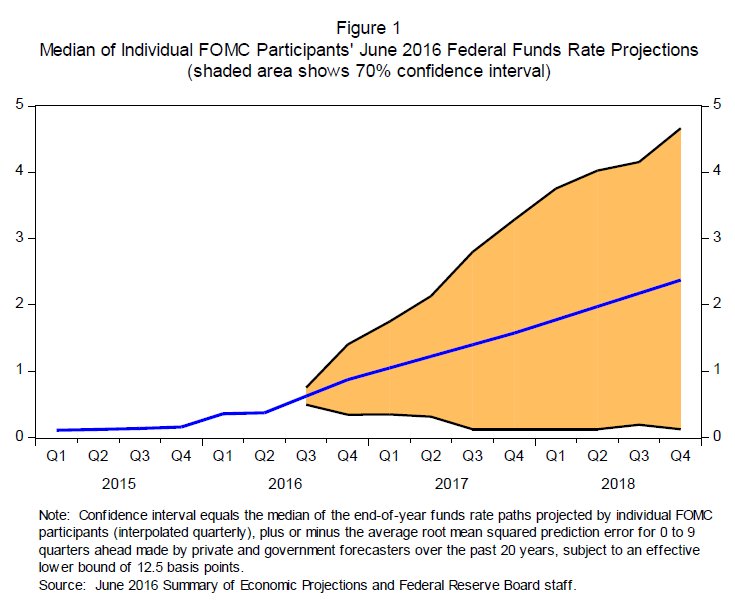

Janet Yellen's Graph of Potential Rates Through 2018. We count a dozen 25 basis point hikes

FTA "Why Gold Bulls Should Want a Rate Hike

How to Reload?

How can one reconcile the potentially disastrous effects of a rate hike on: the election, the stock market, and the actual economy with the need to be ready for a crisis? The answer for us is simple but not easily done. Create the crisis by raising rates. This may sound conspiratorial, but we are not saying that the Fed wants to create a crisis. We are saying that the Fed wants to fix the economy. And though one may think its efforts may be compromised and wrong, those in the FOMC believe their own intentions. And to that we say, they have to raise rates at some point soon. And when they do, it will create the crisis they need to convince the world that QE and more is the only answer.

Central Bank Coordination is Imperative.

In the global scenario we have been seeing tells that QE and more is coming on a globally coordinated basis. We think ground zero for the implementation of Helicopter money being officially used will be in Japan. Remember when Bernanke made his trip to speak with Kuroda about a month or so ago? That was to get people on the same page while keeping the Fed at a perceived arm's length away.

So while we remain flexible on the tactics potentially employed, the strategy remains the same.

So how does it happen? We are not sure and are never married to the order of events. Being able to create tangents within a framework of concepts is easiest and keeps our thought process least biased. But right now it could go like this:

- Japan will start the ball rolling. Stocks and Gold will rally there in yen terms. Japan started this global deflationary cycle. They should be the first out of it.

- China will have to further accelerate its Yuan depreciation against the USD. Remember their reaction to the Brexit vote? China potentially lost a favorable link to the EU via its relationship with the UK

- The UK and EU will also then consider more QE and helicopter money. Their reasons will be different, but their actions will be the same. For the EU it will be to rescue Italian banks. For the UK, it will be to help their exporting commerce.

- There will be a "whiff" of inflation but no-one will pay much attention

- The US will be forced to capitulate on its own Fiscal stimulus citing the damage done to our economy by a strong dollar etc.

- Stocks, bonds and Gold will rally with Stocks outperforming everything in what should be a massive blowoff top for them and Bonds

- Somewhere in this mix, the Fed will have to raise rates

So that has been our feel: not married to the order of events, but strongly believing in the outcome nonetheless

Next Week: Double Fed Whammy

Next week we have a rare but not unprecedented BOJ/FRB same week announcement. If the BOJ is going to do as we predict, Tuesday evening would be a great time to do it.

- The BOJ will decide on rates next Tuesday.

- The FRB will decide on Wednesday

In the past, the BOJ held off announcing its decisions until after the US Fed has made its statement. Almost in deference to its bigger cousin. Chronologically: BOJ meets, US Fed meets, US Fed announces, BOJ announces. But a BOJ QE announcement before a US Fed announcement could solve both Central Banks' problems if done ASAP pre FRB statement. And neatly satisfy our thesis that the Fed raises on a SPX price spike lacking "data reasons". Here is how it could play out:

- A BOJ QE announcement would cause global markets to rally.

- This would in turn give the Fed the opening it needs to raise rates, citing outside reasons.

- Bonus- Obama gets to say Trump is wrong about Political influence on the Fed

And the Fed needs to raise rates at some point, if only to reload its gun and unleash the QE of all QEs. We just think that will be post election unless some event gives them the pretense for which they have been looking sine last month (Fischer, Aug jobs, etc). In price terms:

- SPX over 2300= rate hike.

- SPX under 2100= nothing

- SPX in between 2100- 2300= indecision

- SPX under 2100 in a crisis= intervention, PPT or QE

So while we think the BOJ wll lead in the next round of stimulus, we are not married to that order. What we are married to (barring a selloff it cannot just bully back up) is the Fed must raise rates prior to its own QE announcement. And it would be much easier to do that after some exogenous event causes US stocks to rally. Especially since they cannot get domestic data to corroborate their wishes. Otherwise they must cause their own crisis in the form of raising rates adn 100 SPX points later announcing a QE4 plan.

This is all conjecture on our part. But it is based on the feeling that:

- The global economy cannot stand another US Rate hike unless it has unleashed a QE program.

- Conversely, the US cannot raise rates unless some Global QE event puts a little froth in our own equity markets.

- GM: The Gold-Silver Spread Gets its Shot and the View From FedLand

- HFT Spoofing Mechanics in Gold and Silver- Part 1 of 3

- GS Gives Stocks 5 Reasons to Worry, and We like Gold Above $1333

The Pros and Cons of a Fed Hike on Wednesday- From Soup to Nuts

Technical observation- Head and Shoulders? h/t @popescuCo

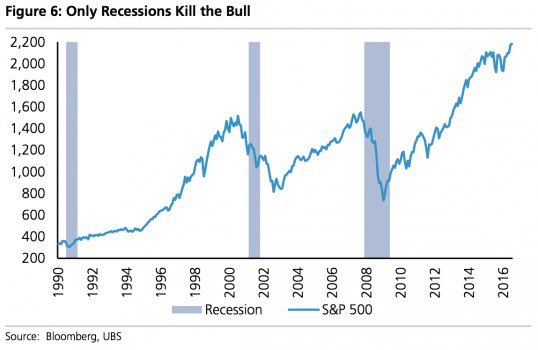

Only Recessions Kill the Bull

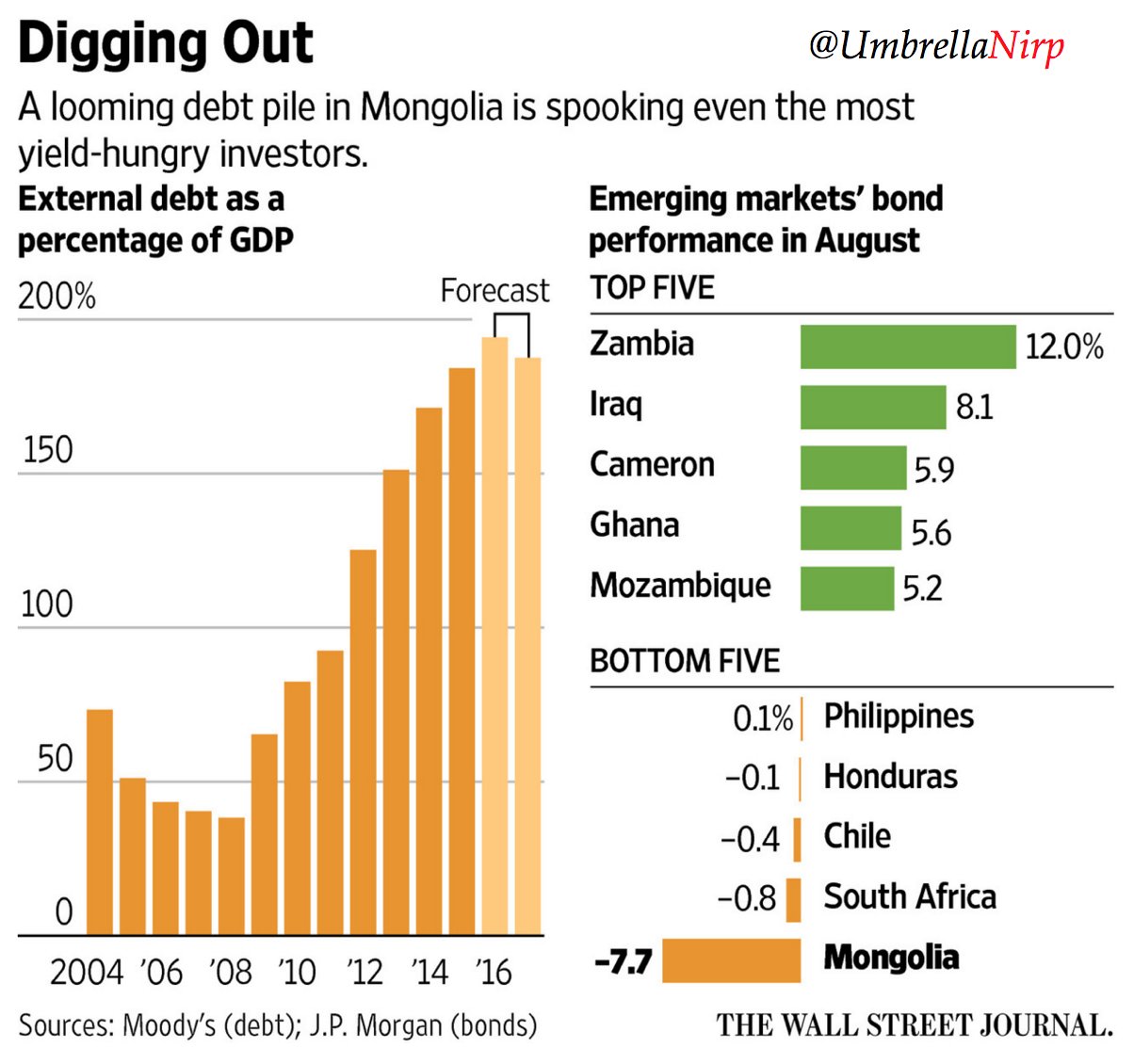

Smaller Countries as proxy for bigger problems ahead?

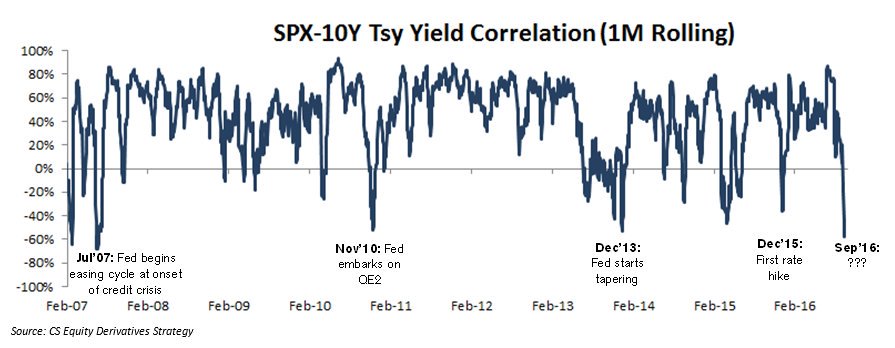

10yr/ SPX Correlation near 10 year Low- raised rates in 2015, QE2 in 2010?

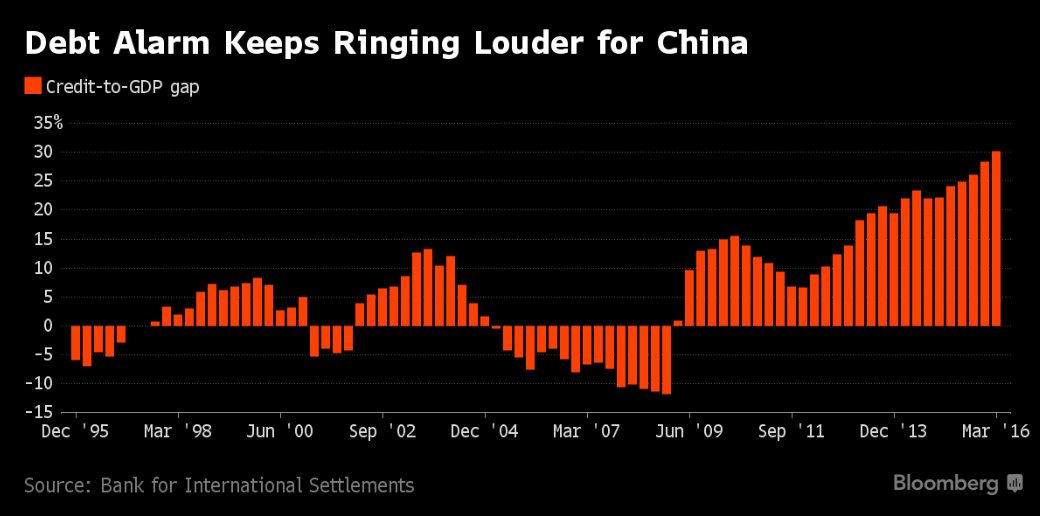

Chinese Debt and shrinking currency reserves- a US Rate hike could be disastrous

“The seventeen year river of currency reserve buildup is no longer flowing.”-David Tepper

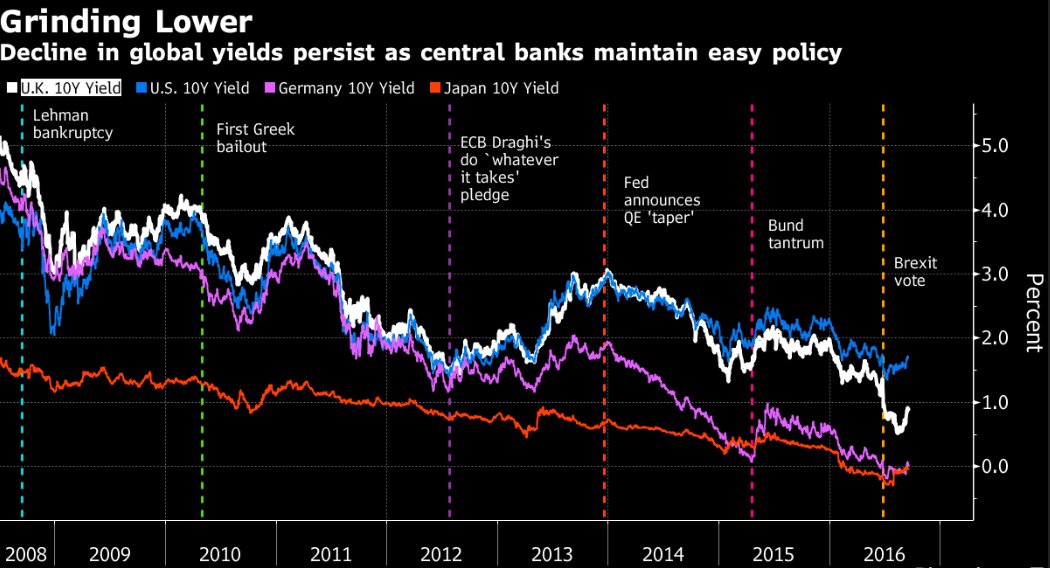

CB Bias is to Avoid Deflation at All costs

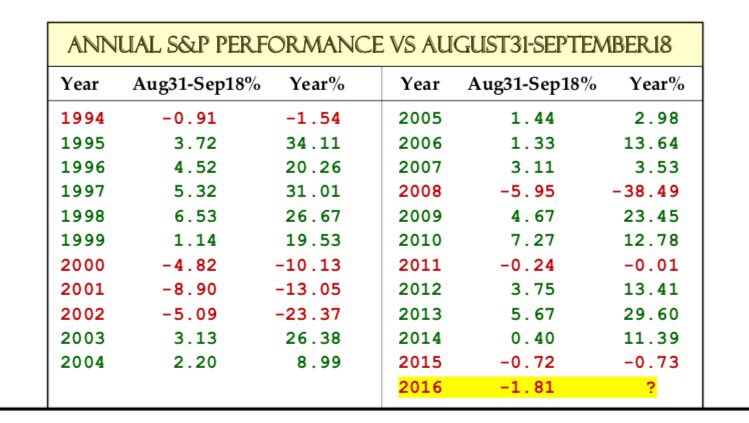

As goes September so goes the rest of the year?

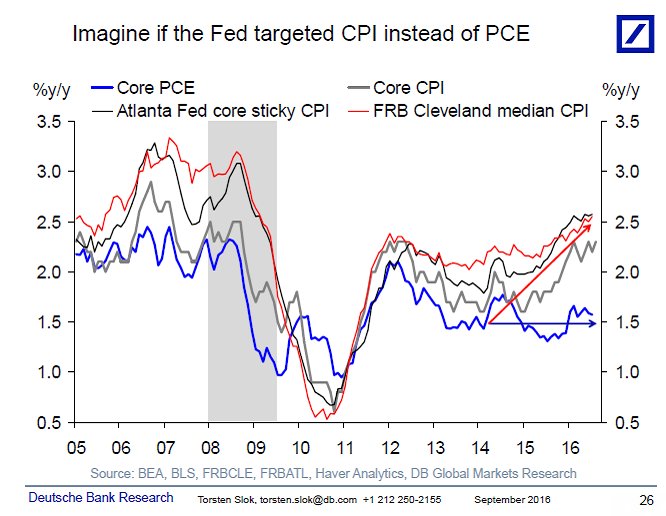

DB Worried About inflation- also want a QE4

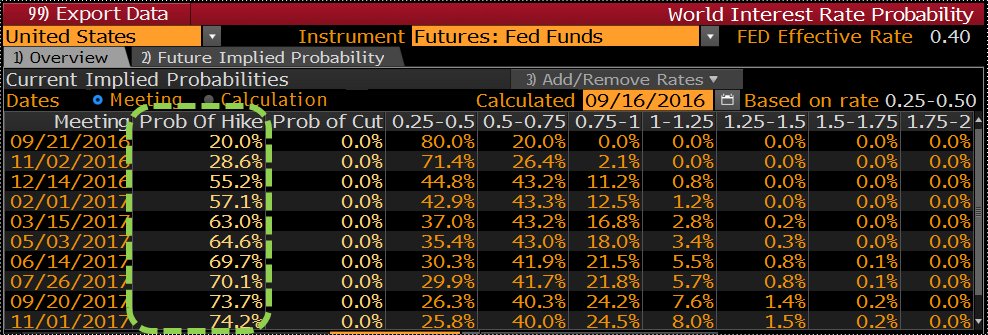

Market Not Discounting a Hike?- implies overreaction if one comes

Autos Say Economy Stalling

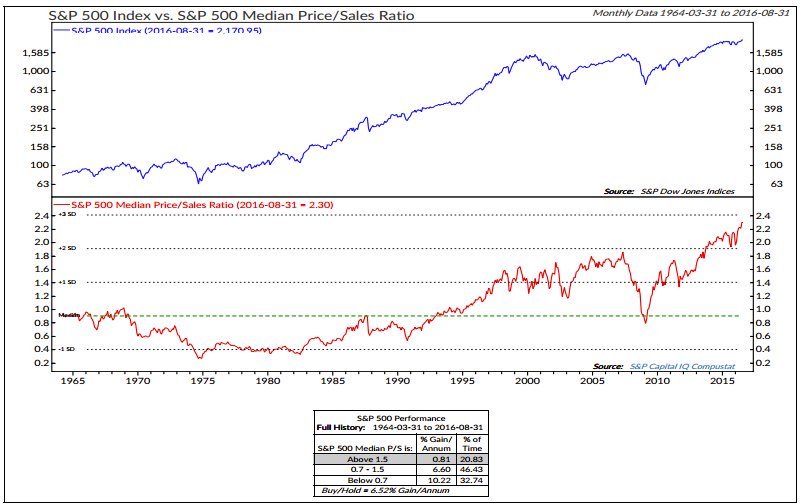

But Price to Sales Ratio on SPX looks very expensive

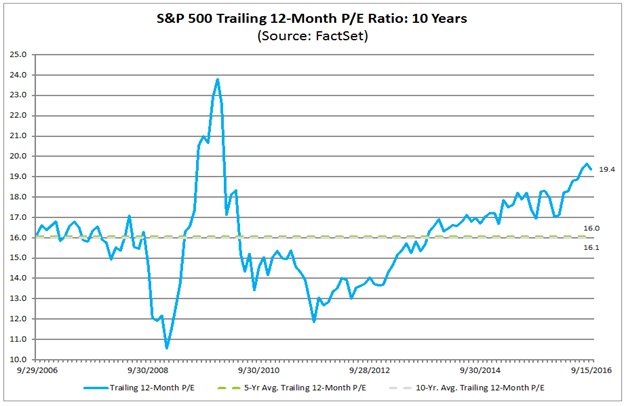

SPX Pe Ratio is 19.4 trailing

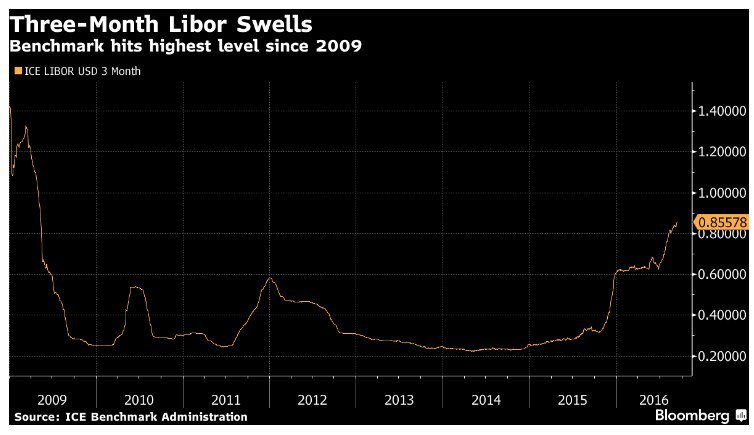

LiBOR Rising- EU banks starting to mistrust each other?-would be even bigger issue if US raised rates.

Funds are Exiting Gold- buy we feel can be more Oil selloff related.

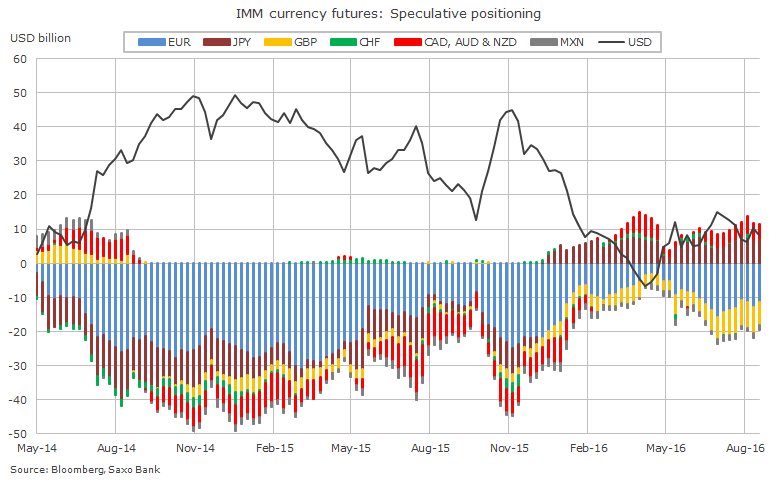

Last Month Funds Reduced USD bets pre- Inflation Jump- end of USD bull run or just a trade?

Conclusion

Market Forces:

We hazard a guess that although the Fed wants to raise rates, it will not , citing China as concern. If it does raise rates without a BOJ QE announcement then we think it will create theselloff crisis needed to unleash the Qe Kraken. Wall street firms had trotted out the bearish analysis starting on Thursday. They need another injection or they will die!! And theyy ain't backing Trump.

We think if BOJ announces a QE then the Fed can safely raise rates. The EU could tehn follow with another stimulus plan of its own as well.

Politics

It is not easy to do what they want in this environment. Hillary down 5 to +10 means no hike. If Donald looks like a landslide winner, then the Fed gets cut losse to do as it wants. Otherwise it's win, win for Donald. And rates will be raised in December.

Recession in Q3

We will bet you straight up that there will be a positive quarter in Q3 pre - election... but not until after rates are not raised.

Soren K.

Read more by Soren K.Group