Jay Taylor’s Inflation/Deflation Watch (IDW)

Jay Taylor’s Inflation/Deflation Watch (IDW)

Michael Oliver’s momentum work has warned of a major plate tectonic shift in major market categories. Specifically he calls for a major bear market in stocks and bonds and a major bull market in commodities, led by precious metals.

To find out what is actually taking place in these categories, I decided to check the relative performance of the Rogers Raw Materials Index vis-à-vis my Inflation/Deflation Watch (IDW). Not surprisingly, we are now witnessing a bottoming out of commodity prices relative to my IDW.

To find out what is actually taking place in these categories, I decided to check the relative performance of the Rogers Raw Materials Index vis-à-vis my Inflation/Deflation Watch (IDW). Not surprisingly, we are now witnessing a bottoming out of commodity prices relative to my IDW.

Also, not surprisingly, the peak in commodity price inflation since the Jan. 31, 2005 inception of my IDW took place just prior to the housing market crash. Massive money created out of thin air by evil central bank policies created an illusion among the masses that you could have something for nothing. This was the peak of the age of liar loans and the housing market mania that led to the most horrific financial collapse in our nation’s history and it is a crisis that is not yet over. In fact, the capitalist system itself is being destroyed by the Federal Reserve Bank because it is not allowing price discovery of capital.

To put into perspective the post-crash commodity carnage and the pain subscribers to this letter have felt since the sinful Bush housing market peak on June 27, 2016, I have constructed the chart and table below.

Let me share a couple of observations.

- Check out the IDW chart on the previous page. Despite trillions upon trillions of dollars of new money pumped into the economy, the IDW is rolling over and may be ready to decline dramatically once again. This is not difficult to imagine, especially if Michael Oliver’s work is right in suggesting the 30+ year bull market for debt is ready to head into a prolonged bear market, meaning that interest rates are about to rise dramatically. Whatever the case, pumping money into the banking system has been an even bigger abysmal failure now than it was in the 1930s.

- The Commodities to Dow chart also on the prior page shows the overall decline of the broad-based commodities Rogers Raw Materials Index to the IDWl. Now however, consistent with Michael Oliver’s work, commodities (Rogers index) appears to be bottoming out.

- Note the dramatic decline of the real economy assets in my IDW like copper and oil. In addition, I would note the China stock index is also down considerably, no doubt because the real economy has remained in the doldrums since the false boom that ended with the housing crisis. But copper and oil, which are two very important ingredients in the IDW, were down dramatically.

- Gold and the dollar index have both gained since the financial crisis. Since June 27, 2008 until now, the dollar has gained 26.3% and gold 26.16%. That suggests to me that both the dollar and gold remain safe haven monetary assets. Silver is down 0.23% during this decline compared to massive decline for copper and oil. That suggests to me that silver continues to carry with it a degree of monetary value as well as industrial value.

Oliver’s work which has been so reliably good suggests we are nearing a major rise in commodities. Given my views that we are in an ongoing debt deflation and that the long sought escape velocity promised by a fraudulent Keynesian model can never occur, my thinking is as follows: Interest rates are likely to rise, not because the Fed wants that to happen, but because the markets will demand it. With rising rates will come a crash in both debt and equity markets. Given an ongoing depression, gold is likely to rise in both nominal and real terms while basic commodities like oil, copper and other base metals are likely to rise relative to stocks and bonds, but not necessarily in nominal terms. And, keep in mind that the best environments for gold mining stocks is one in which commodities and basic materials prices decline relative to gold.

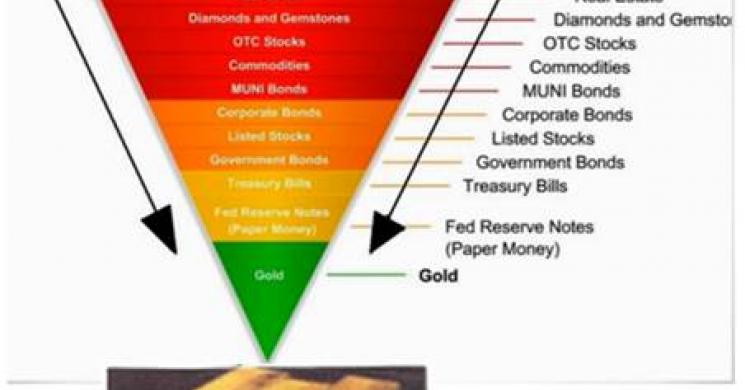

I noted above that since the 2008 housing and stock market crash, the dollar and gold have gained almost the same amount relative to my IDW. Also, you will note that long dated U.S. Treasuries have been stellar performers, having gained 29.84% since then. That is entirely consistent with what we expect from Exter’s inverted pyramid. As the system becomes ever more leveraged, the real economy shrinks and there is a rush toward liquidity and solvency. The risk-off trade therefore is moving toward dollar and dollar instruments, most notably U.S. Treasuries. But this time risk off has increasingly involved a move toward gold. Thus gold is leading the commodity move higher as Michael Oliver constantly reminds his readers.

Ultimately, the dollar will be seen for the fraud that it is. When that day arrives and the dollar system implodes, there will be a mass exodus from paper gold (contracts, etc., not backed by actual gold) shown as the green triangle and into actual gold bullion. When that day arrives, the $26,000/oz gold value discussed in a recent piece written by Frank Holmes may not be so farfetched. Indeed if the dollar becomes worthless, the price of gold valued in dollars could approach infinity. But realize that the value of gold in terms of other goods and services will have remained constant. It’s only the dollar and other currencies that are backed by I.O.U. Nothings that will fail. It’s only a matter of time. As the Anglo American Empire runs out of markets to exploit and as Russia, China and India build the new Silk Road as well as their own banking in trade infrastructures (which our media never mentions), it’s difficult for me to see how the existing dollar-based global monetary system can be long for this world. If a nuclear war between the U.S. and Russia can be avoided, it’s difficult for me to see how the fortunes of those owning gold and gold mining shares should not run to new highs over the next several years.

Jay Taylorwww.jaytaylormedia.com www.miningstocks.com

Read more by jaytaylor