We apologize if all the commodities are not up today. However, they will continue to rise in anticipation of demand, a weaker dollar, and ultimately domestic inflation. And remember, the USD is strong now. - Soren K.

Stated in a prior post (link at bottom)

Bonds First, Gold Last to the Inflation Party?

You have to be nuts to sell Gold as a part of your portfolio. If you have the proper allocation of Gold to stocks, then last week should have been a good week for you. Speculation is a different story. But when stocks go up and Gold goes down, be happy. Bonds? In a normative market, Bonds predict, Stocks predict less so, industrial commodities react in real time, and Gold lags.

Bonds are discounting 2 years down the road again. That is because the government is not going to be manipulating them with QE we feel. That is your compass to know that gold will do well in the future. The key for you as an investor is to keep rebalancing your portfolio as stocks rise and Gold drops.

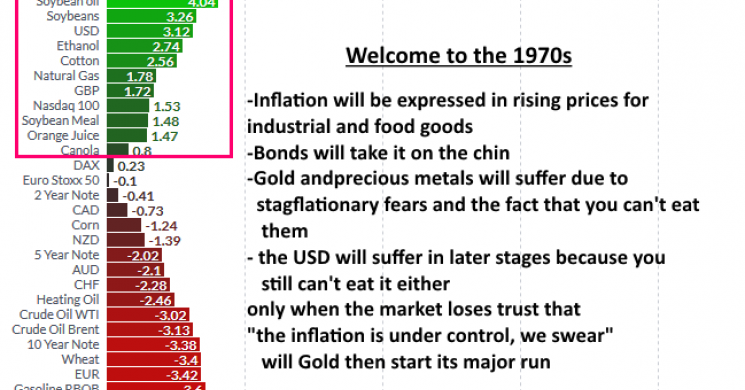

Futures 1 Week Performance

Futures MTD

Previously

Bonds First, Gold Last to Inflation Party- 1970's Redux

Apologies, thie linked post is missing some pics. We recently switched over to a new Host Platform, and some pics just didn't make the trip. Hopefully the words will suffice

Read more by Soren K.Group